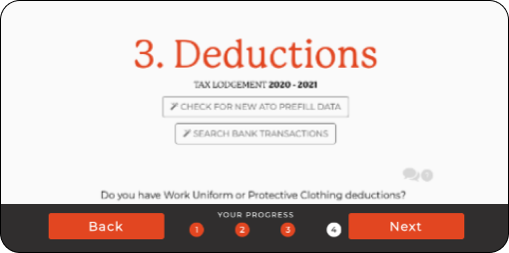

Calculate your estimated Tax Return in 4 easy steps

Our quick, simple and easy process lets you check the Tax Refund amount with an in-built Tax Return Calculator. Use our easy deductions finder to boost your refund, preview your estimated refund amount, and lodge when you’re satisfied!

Pay nothing up front! Only $19 extra

Income details automatically entered

Professionally reviewed

Quick turnaround

Trusted nationwide by

Finish your Tax Return in minutes

No PAYG or Income Statement needed

Pre-filled income details & deductions

Get live help from a qualified accountant

Pay nothing up front! Only $19 extra

How One Click Life

simplifies your taxes

Save time with pre-filled income details

One Click Life automatically pulls data from the Australian Tax Office, pre-filling your tax return details, to save you time and hassle of locating your PAYG or income statement.

Get help with maximising your refund

We are with you every step of the way, so you don’t have to face the ATO alone. Talk to a friendly, trusted tax accountant about which tax deductibles you can claim and boost your tax refund, stress-free.

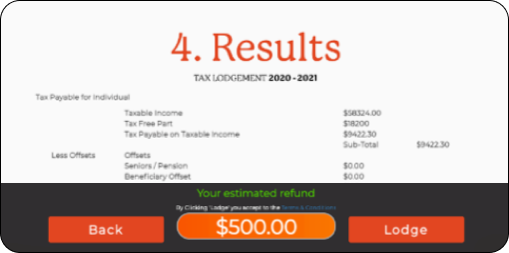

Preview your estimated tax return

Our quick and easy application lets you calculate your tax return and get a glimpse of how much you’re owed before lodging your tax.

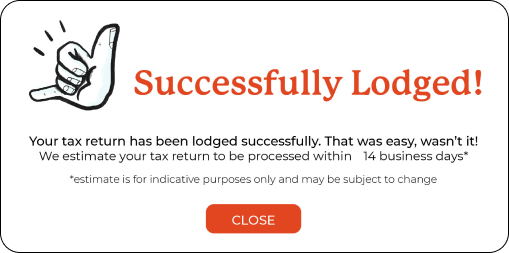

Feel confident about your tax

Enjoy the simplicity and speed of doing your tax, and leave the rest to us. Our trusted & reliable accountants review it one last time for ATO compliance, before it is lodged.

Have a fuss free weekend: we’ll take care of your tax

Complete your tax return with live help from a qualified accountant

Remember you don’t have to face the ATO alone. At One Click Life, we have made doing your online Tax Return convenient, easy, and stress-free. There’s no messy paperwork or confusing tax jargon. We’re on your side to help you get a better tax refund while making sure you’re in the good books with the ATO.

Spend less time on tax

Your time is important. Our simple and convenient process only takes a couple of minutes, so you can get back to doing what you love.

Boost your refund

Claim more on expenses with our easy deductions finder, or boost your tax refund with live help from a qualified accountant.

Enjoy financial freedom

We’ll take care of your taxes, so you can focus more on living your life, free of financial stress.

Feel more confident

We’re on your side and help you reduce the risk of being audited, so you don’t have to face the ATO alone.

All your information protected

Verified & secured by Microsoft, your information is safe and encrypted with Australia’s first and only, advanced security system that’s anti-fraud.

Over 100,000 Aussies have selected One Click Life!

Nervous about completing your Tax Return online by yourself? Over 100,000 Aussies have already created an account with One Click Life! Our very simple and easy to use online Tax Return has fast become the #1 online tax agent of choice by Australians all across the country.

“Simple, no frills, maximum return!”

Simple and very convenient!

Very easy to use, simple and straightforward. Not to mention very convenient. Will be using this service in the future.

Ebony C

Godsend for people who can’t get to a tax agent office

Took about 10 minutes on the phone and my return estimate went from me owing ATO to getting a thousand back. Being able to do it from home was a game changer.

Kelly

So simple, quick and efficient

They have done 3 of my tax returns so far and I’ll be sticking with them. So simple, quick and efficient and any queries or questions are explained with excellent customer service. Thank you.

Shenai W

Pay nothing upfront!

Our fees can be automatically deducted from your refund, so you don’t have to worry about paying anything right now. Only $19 extra (T&Cs Apply)

Need your money sooner? Get a Next Day Refund! Only $89 extra (T&Cs Apply)

Individual Tax Return

$99

- Account links directly to ATO

- Fast and efficient

- Lodge when you want, on any device

- Safe & secure

- *Reduced to $29 for nil tax paid returns lodged automatically

Optional Extras

- Get Next Day Refund!

Only $89 extra (T&Cs Apply) - Pay nothing up front!

Only $19 extra (T&Cs Apply) - See all fees

Rental, Investor & Sole Trader

$249

Our advanced Tax Return is actually quite simple. Our techy dudes (Code Monkeys) have made it extremely easy to lodge your Tax Return with a dedicated accountant (Numbers Geeks) support. You also get free dedicated accountant tax advisor support either via message or phone.

Popular Questions

How long does it take to get your return?

Normally, it will take 14-21 business days for ATO to process your tax return. However, if it is a prior year tax return then it could take a bit longer than usual (around 30 days).

Why must I verify my photo ID?

There have been new ATO regulations that require tax agents to verify all clients ID. Thus, to protect your potential refund, we are required to ensure that it is you who is lodging your Tax Return, and that you get your refund.

Where can I find my Tax File Number (TFN)?

You can find your TFN on your PAYG payment summary, Notice of Assessment or alternatively, you can contact the ATO by calling 13 28 61.

I can’t activate my account or I did not receive my activation email

Have you checked your spam or junk inbox? The activation email might have ended up there. If you still can’t find the activation email, please feel free to contact us by calling 1300 707 117. One of our staff will be able to help you activate your account.

Can I lodge prior year Tax Returns?

You can complete and lodge your prior year Tax Returns from 2017 onward on our website. However, for 2016 and earlier you will need to contact us at [email protected]. Do note that there may be additional fees, as those Tax Returns will have to be done manually by one of our accountants.

Can I lodge my Tax Return if I am on a Working Holiday Visa on your website?

Yes, you can complete and lodge your Tax Return on our website.

Can One Click Life transfer refund into my international bank account?

Yes, we can transfer your refund to the international bank account but there will be an additional remittance fee. (please email at [email protected]).

I put in the wrong bank details

No worries, please send us an email at [email protected] and we will send you the instructions to amend your bank details. We may request that you send us a copy of a bank statement that you want your refund to be deposited into.

I need to change my phone number/email?

Please send us an email at [email protected] or contact us at 1300 707 117. Please have a copy of your ID ready as we may request it.

What is my linking code for linking MyGov account?

You can contact ATO to link your MyGov account by calling 13 28 61