The easiest no paperwork

no appointments

no worries

online Tax Return

you will ever do.

Our simple, quick and easy process helps you get a better tax refund without any stress. Lodge your Tax Return from your couch with our friendly tax agents online today.

Already have an account? Sign in now

Trusted nationwide by

Finish your Tax Return in minutes

Pay nothing up front! Only $19 extra

Pre-filled income details & deductions

Get live help from a qualified accountant

No PAYG or Income Statement needed

Pay nothing upfront!

Our fees can be automatically deducted from your refund, so you don’t have to worry about paying anything right now. Only $19 extra (T&Cs Apply)

Need your money sooner? Get a Next Day Refund! Only $89 extra (T&Cs Apply)

Individual Tax Return

$99

- Account links directly to ATO

- Fast and efficient

- Lodge when you want, on any device

- Safe & secure

- *Reduced to $29 for nil tax paid returns lodged automatically

Optional Extras

- Get Next Day Refund!

Only $89 extra (T&Cs Apply) - Pay nothing up front!

Only $19 extra (T&Cs Apply) - See all fees

Rental, Investor & Sole Trader

$249

- Simple process & platform

- Lodge with a dedicated accountant

- Tax advisor support over phone or message

Complete your Tax Return with live help from a qualified accountant

You don’t have to face the ATO alone. At One Click Life, we’ve made your online Tax Return convenient, easy and stress-free. Forget messy paperwork and confusing tax jargon. Let us help you maximise your tax refund and stay in the good books with the ATO.

Spend less time on tax

Your time is important. Our simple and convenient process only takes a couple of minutes, so you can get back to doing what you love.

Maximise your refund

Get dedicated tips from our friendly, numbers geeks and boost your tax refund.

Enjoy financial freedom

We’ll take care of your taxes so you can focus more on what matters most in life — going on adventures.

Feel more confident

We’re on your side and help you reduce the risk of being audited, so you don’t have to face the ATO alone.

Environmentally friendly

Paperwork isn’t just annoying, it’s bad for the environment. Use One Click Life and do your Tax Return the green way.

All your information protected

Verified & secured by Microsoft, your information is safe and encrypted with Australia’s first and only, advanced security system that’s anti-fraud.

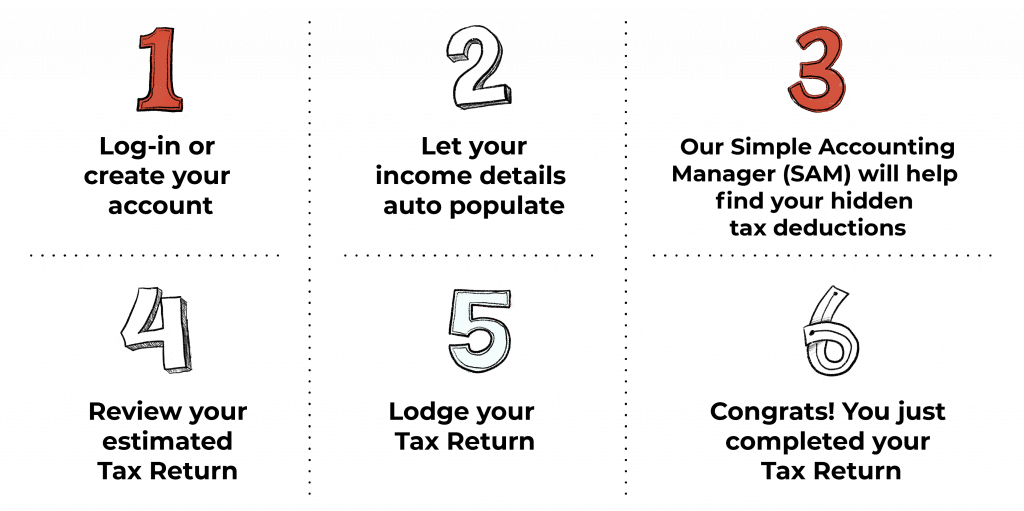

How to complete an online Tax Return with One Click Life

If you earn income, you’ll need to complete a Tax Return every year. Making an account with One Click Life will help you speed up the process in the future!

Haven’t organised all the information you need for your Tax Return?

Create an account with One Click Life and keep everything you need in one place.

How to lodge your Tax Return in 60 Seconds

A quick and easy way to do your taxes with One Click Life

Save time with pre-filled income details

One Click Life automatically pulls data from the Australian Tax Office, pre-filling your Tax Return details, to save you time and hassle of locating your PAYG or income statement.

Get help with maximising your refund

We are with you every step of the way, so you don’t have to face the ATO alone. Talk to a friendly, trusted tax accountant about which tax deductibles you can claim and boost your tax refund, stress-free.

Preview your estimated Tax Return

Our quick and easy application lets you calculate your Tax Return and get a glimpse of how much you’re owed before lodging your tax.

Lodge your tax with confidence

Our trusted accountants review your tax details and deductions to make sure everything is correct and ATO compliant. If we notice missing deductions or something is wrong, we’ll contact you before it is lodged.

Over 100,000 Aussies have selected One Click Life!

Nervous about completing your Tax Return online by yourself? Over 100,000 Aussies have already created an account with One Click Life! Our very simple and easy to use online Tax Return has fast become the #1 online tax agent of choice by Australians all across the country.

“Impeccable customer service experience, highly recommended, helped with understanding everything”

Absolutely amazing staff!

Absolutely amazing staff! Heather deserves a raise!!! So appreciative of how great she worked with me for my first time completing my tax return. 10/10 would recommend one click!

Tahlia

Godsend for people who can’t get to a tax agent office

Took about 10 minutes on the phone and my return estimate went from me owing ATO to getting a thousand back. I work from home due to personal circumstances and could never get to a tax agent. Being able to do it from home was a game changer.

Kelly

Nothing but excellent service

From the very first email to the last we exchanged, I got nothing but excellent service. Super quick and accurate work. Ning did an outstanding job. Highly recommended. Thank you, I will definitely be getting One Click Life to complete my return next year.

Sandra B

Love love love and more love!

Nathan ❤️ from One Click Life is a life saviour! I was told by Etax that I owed $3,186. After dealing with Etax for more than a month, it only took 10 minutes for Nathan to figure out that I’ll receive some money instead. He was really polite, cool, helpful and funny. Dude you just made my day!

Deb

Want to lodge your Tax Return from your couch in minutes?

We’re on your side and help you reduce the risk of being audited, so you don’t have to face the ATO alone.

Ready to do your Tax Return online?

Don’t face the ATO alone. Our new online Tax Return is convenient, simple and so easy that it allows young Aussie families and adults to finish their Tax Return in minutes.

No appointments, no paperwork

Live help from online tax agents

Spend less time on tax

Maximise your refund

Enjoy financial freedom

Feel more confident about taxes

All your information secured & protected

Not sure what tax deductions to claim? Look up your occupation

No matter the profession, no matter the position, no matter your income, we make tax returns easy for almost every Australian. Have a look at what you can deduct:

Frequently Asked Questions

To understand the question “how much will I get back from tax”, you’ll need to enter your taxable income and tax paid in a tax calculator or create an account on One Click Life and open the return. This will precisely answer the question “how much will I get back from tax?”.

An online tax return will cost $99 to complete if it is a standard tax return. If you want to know how much is tax return for a nil tax return, the answer is $29. This is a tax return where you have had no tax withheld during the year and earned under the tax free threshold. How much is tax return for sole trade, investor or crypto trader? These are more complicated and we provide a thorough review of these tax returns. These type of tax returns cost $249.

The easiest way is to lodge your tax return online. This can take as little as 5 minutes to create an account and complete your tax return online.

A tax deduction is something that reduces your taxable income and increases your tax refund. A tax deduction needs to relate directly to earning income. You can see our blog here for more information What is a Tax Deduction? | One Click Life.

The whole process from registration to lodgement of a quick Tax Return is under 15 minutes. We have had some customers take under 5 minutes! The Online Tax Return is an intuitive and easy Tax Return to complete.

Forget sifting through emails for your PAYG or Income Statement come tax time. One Click Life will sort out that information and automatically add it to your Tax Return for you. Completing an online Tax Return should be easy, that’s why we connected directly to the ATO to save you time and make it a quick Tax Return.

There have been new ATO regulations that require tax agents to verify all clients ID. Thus, to protect your potential refund, we are required to ensure that it is you who is lodging your Tax Return, and that you get your refund. We have made the ID check as easy as possible so you can complete your online Tax Return easily.

You can find your TFN on your PAYG payment summary, Notice of Assessment or alternatively, you can contact the ATO by calling 13 28 61. You will need your TFN to complete an online Tax Return.

Have you checked your spam or junk inbox? The activation email might have ended up there. If you still can’t find the activation email, please feel free to contact us by calling 1300 707 117. One of our staff will be able to help you activate your account.

There are a number of options to complete a tax return. The easiest is to complete your tax return online with an online tax agent like One Click Life. Creating an account and lodging your tax return can take as little as 5 minutes.

Please send us an email at [email protected] or contact us at 1300 707 117. Please have a copy of your ID ready as we may request it.

You can contact ATO to link your MyGov account by calling 13 28 61

Normally, it will take 14-21 business days for ATO to process your Tax Return. However, if it is a prior year Tax Return then it could take a bit longer than usual (around 30 days). An online tax refund is the quickest way to access your refund.

No worries, please send us an email at [email protected] and we will send you the instructions to amend your bank details. We may request that you send us a copy of a bank statement that you want your refund to be deposited into.

Yes, we can transfer your refund to the international bank account but there will be an additional remittance fee. (please email at [email protected]).

You can complete and lodge your prior year Tax Returns from 2017 onward on our website. However, for 2016 and earlier you will need to contact us at [email protected]. Do note that there may be additional fees, as those Tax Returns will have to be done manually by one of our accountants.

Yes, you can complete and lodge your Tax Return on our website.

It is free to create an account and look at your HECS debt or HELP Debt. If you want to know your HECS repayment you can talk to our team at [email protected]

You will have to lodge a Tax Return and you may be in for a pleasant surprise and receive an online tax refund!

It is free to open an account and your wages will show up automatically in your online Tax Return.

The easiest way to do your tax is online with One Click Life. It takes only 5 minutes and can be done easily from your mobile phone.

If you want to do a tax return online fast, create an account with One Click Life and from your mobile phone you can complete it in 5 minutes.

A tax return brings together all your income, reduces it by your tax deductions to work out the tax you need to pay. Then adjusts for the tax your employer has withheld from your payslips to give you a next result. This net result is your tax refund.

A common search question is how much I will get tax return. To get a precise idea it is free to create an account and check with One Click Life. Just login, open your tax and you’ll see your tax return amount. Add expenses to watch your tax return increase.

If you lodge your tax return on time each year, your tax lodgement date should be 15th of May if you lodge through a tax agent like One Click Life. Most people want to access their tax refund quicker though!

If you’ve earned under the tax free threshold you will get all the tax you’ve paid back. Otherwise you will need to log in to One Click Life to check how much you get back in taxes.

To know how much do you get back from tax, you are best to complete a tax estimate from One Click Life. Just login, ID check and you’ll see your tax estimate. Add expenses to watch your tax refund increase.

To know the answer to how much should I get back in taxes, it’s easiest to run a free tax estimate with One Click Life. Just login and open your tax return to see what you will get back in taxes. Add tax deductions to watch your tax refund increase. You can also use our handy tax calculators here: Tax Calculators

Lodging a tax return online is easy! It can take as little as 5 minutes to create an account and lodge with an online tax agent like One Click Life. You can see a video of how to lodge a tax return here.

https://www.youtube.com/watch?v=s2L-JvoIsk0

Your tax refund will depend on your taxable income and how much tax your employer has withheld during the year. The average tax refund in Australia is $2,900.

Tax deductions reduce your taxable income and need to directly relate to earning your taxable income. A tax deduction generally increases your tax refund.

To claim your tax return in Australia you just need to jump online with One Click Life. Select the year you want to complete and all the details will already be in the tax return. You just need to add your tax deductions if you spent money to earn your income and then hit lodge. The online tax return can be completed in 5 minutes.

The easiest way to do your tax return is online. All your details and income will be prefilled and you just need to either hit lodge or add tax deductions to your online tax return.

An online tax return is the easiest way to complete your tax return. It’s so simple because all your details and income will automatically appear in your tax return. You just need to add in any expenses, or tax deductions, you’ve made during the year then hit lodge.

To do your tax, jump online with One Click Life. It’s a 5 minute online tax return that does tax for you. It’s easy to use and can be done on your mobile phone in 5 minutes.

The tax year runs from 1 July to 30 June the next year. Generally you need to lodge your tax return between 1 July and 31 October, but if you’re up to date and registered with a tax agent like One Click Life you will have until the 15th of May to lodge your tax return.

The easiest way to do your own tax is to complete it online using One Click Life. It’s simple to use and only takes about 5 minutes from your mobile phone.

Doing your tax return online is the easiest way to do your tax return. When you log in to One Click Life for example, your online tax return is pre populated with all your details. You just need to add in any tax deductions then hit lodge. In a short period of time, generally 10-14 days, your tax refund arrives. The average tax refund in Australia is $2,900.

To file a tax return in Australia you can either find a tax agent and visit one or complete it online in 5 minutes from your mobile with an online tax agent like One Click Life.

To get a tax return you will need a tax file number. Once you have this your earnings are attached to that number. You are required to lodge a tax return every year. The easiest way to lodge is to complete an online tax return using an online tax agent.

To maximise your tax return understand what expenses are tax deductions and retain your receipts. Also keep logs of any work related travel you do in your car and any hours you work from home. These all reduce your taxable income and increase the refund you receive from the ATO on your tax return.

The ATO generally take 10-14 days to process your tax return and release your refund. Need your money sooner? Get a Next Day Refund! Only $89 extra (T&Cs Apply)

A tax return starts from 1 July.

Latest Articles

-

How to request a Centrelink Payment Detail Report

Complete the following steps to download your report

-

AIA Health July 2025 Offer

Get up to $600 cashback* on your health insurance when you take out a combined … Read More

-

These are the five dumbest things smart people waste money on

In a recent article for news.com.au, our CEO Mark Waller revealed the five “dumbest” things you … Read More

-

Microkeeper & One Click Life

At One Click Life, we’re always looking for ways to make tax time simple, and … Read More