Small BusinessAffordable

Deductible

Tax Returns

and Financials*

Simple, fast, fixed fee, transparent way to lodge your Business Tax Return… all without leaving your home!

to commence your Business Tax Return

Already have an account? Sign in now

“Now I can get my Company Tax Return completed and my own personal tax in a fast, efficient way and I know exactly what it will cost. I just want to run my business, not worry about tax!”

Dani, Perth

Trusted nationwide by

2 Week lodgement process

Fixed, transparent pricing

Free Advice throughout process

Company Tax Returns

Sole Trader Tax Returns

Tax Returns for Partnerships

Trust Tax Returns

Small Business Tax Return

Sole Trader

$249

Including

- Register for free

- Give us your information and we will do the rest

- Accountant prepared schedules

- Dedicated accountant tax adviser support

Under $1m Revenue

(No Employees)

$499

| Kick off meeting over web | |

| Check bank reconciliation | |

| Review BAS compliance | |

| Check tax deductibility of expenses | |

| Pass any year end journal required in accounts | |

| Create and manage depreciation schedule | |

| Completion meeting over web | |

| Business Tax Return Lodgement | |

| 2 additional free 30 minute tax advice meetings throughout the year | – |

| Check PAYG compliance | – |

| Wages reconciliation | – |

| Check super compliance | – |

| Financial Statements | +$99 |

| Prepare Company/Trust/Partnership minutes | +$99 |

| BAS Lodgement required (each) | +$99 |

| Fix errors in bank reconciliation | +$99/hr |

| Owners Individual Tax Returns (each)** | +$99 |

| Superannuation guarantee lodgements (each) | – |

Under $1m Revenue

(With Employees)

$999

| Kick off meeting over web | |

| Check bank reconciliation | |

| Review BAS compliance | |

| Check tax deductibility of expenses | |

| Pass any year end journal required in accounts | |

| Create and manage depreciation schedule | |

| Completion meeting over web | |

| Business Tax Return Lodgement | |

| 2 additional free 30 minute tax advice meetings throughout the year | |

| Check PAYG compliance | |

| Wages reconciliation | |

| Check super compliance | |

| Financial Statements | |

| Prepare Company/Trust/Partnership minutes | +$99 |

| BAS Lodgement required (each) | +$99 |

| Fix errors in bank reconciliation | +$99/hr |

| Owners Individual Tax Returns (each)** | +$99 |

| Superannuation guarantee lodgements (each) | +$99 |

*Only available for Small Businesses using Xero

**$99 per hour for entering investment activities and rental schedules

Small Business Tax Returns for all entities including:

Company Tax Returns

Sole Trader Tax Returns

Tax Returns for Partnerships

Trust Tax Returns

Complete your Tax Return with live help from a qualified accountant

Remember you don’t have to face the ATO alone. At One Click Life, we have made doing your online Tax Return convenient, easy and stress-free. There’s no messy paperwork or confusing tax jargon. We’re on your side to help you get a better tax refund while making sure you’re in the good books with the ATO.

Spend less time on tax

Your time is important. Our simple and convenient registration process only takes a couple of minutes, so you can get back to doing what you love.

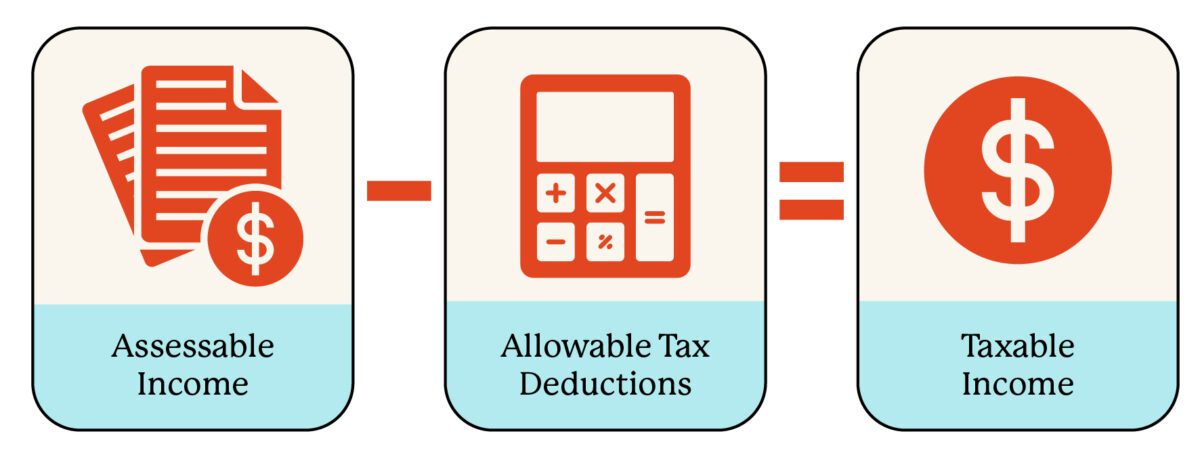

Minimise your tax payable

We’ll review your business expenses to get the most out of what you’ve spent.

Enjoy financial freedom

The process takes 2 weeks start to close. We do the numbers, so you can do life.

Feel more confident

We’re on your side and help you reduce the risk of being audited, so you don’t have to face the ATO alone.

We do things differently

Our cost is fixed. We’re completely open and transparent about our pricing and have automated as much as possible to make your life easy.

All your information protected

Verified & secured by Microsoft, your information is safe and encrypted with Australia’s first and only, advanced security system that’s anti-fraud.

A quick and easy way to do your Business Tax Return with One Click Life

Save time with pre-filled income details

One Click Life automatically pulls data from the Australian Tax Office, pre-filling your Tax Return details, to save you time and hassle of locating your PAYG or income statement.

Get help with maximising your refund

We are with you every step of the way, so you don’t have to face the ATO alone. Talk to a friendly, trusted tax accountant about which tax deductibles you can claim and boost your tax refund, stress-free.

Preview your estimated Business Tax Return

Our quick and easy application lets you calculate your Business Tax Return and get a glimpse of how much you’re owed before lodging your Tax Return.

Lodge your tax with confidence

Our trusted accountants review your tax details and deductions to make sure everything is correct and ATO compliant. If we notice missing deductions or something is wrong, we’ll contact you before it is lodged.

Have a fuss free weekend: we’ll take care of your tax

Over 100,000 Aussies have selected One Click Life!

Nervous about completing your Tax Return online by yourself? Over 100,000 Aussies have already created an account with One Click Life! Our very simple and easy to use online Tax Return has fast become the #1 online tax agent of choice by Australians all across the country.

“Impeccable customer service experience, highly recommended, helped with understanding everything”

Shakirra

Absolutely amazing staff!

Absolutely amazing staff! Heather deserves a raise!!! So appreciative of how great she worked with me for my first time completing my tax return. 10/10 would recommend one click!

Tahlia

Godsend for people who can’t get to a tax agent office

Took about 10 minutes on the phone and my return estimate went from me owing ATO to getting a thousand back. I work from home due to personal circumstances and could never get to a tax agent. Being able to do it from home was a game changer.

Kelly

Nothing but excellent service

From the very first email to the last we exchanged, I got nothing but excellent service. Super quick and accurate work. Ning did an outstanding job. Highly recommended. Thank you, I will definitely be getting One Click Life to complete my return next year.

Sandra B

Frequently Asked Questions

The process takes two weeks start to finish. We set our completion meeting during the initial meeting for 10 business days later. As long as you’ve provided us the information, we can work away behind the scenes and get your completed tax return to you quickly.

One Click Life has a simple pricing table for business tax returns. Base prices for lodging a tax return for business is $499 or $999 if you have employees.

One Click Life has a simple pricing table for company tax returns. Base prices for lodging a company tax return is $499 or $999 if you have employees.

Nope! Just what you see in the pricing and service table. The cost is fixed for the service and if you need assistance with any other service, the costs are also fixed. The only thing we charge on an hourly rate is fixing a bank reconciliation. If your bank account reconciles to Xero – you have no worries!

We will ensure your tax return is correct and lodged with the ATO. We will also provide you a business financial report if required. You get peace of mind that your tax return and compliance is taken care of.

Just the basics.

• Entity name, ABN, TFN

• Access to Xero

• June 30 bank statement

• Copy of prior financials and tax return if available

• Any receipts we request along the way

You’ll have a dedicated tax specialist that you’ll work with directly. You can contact them as much as you like during the two-week period. Once your return is lodged with the ATO we continue to work with you as needed. Our number is 1300 707 117 & our email is [email protected]

Of course, we can! We’re here to help you lodge your tax return and get your compliance up to date. We can lodge old tax returns all the way to current year tax returns.

Once we have completed your tax return we will invoice you for the services you consumed (see pricing and services table). You have 14 days to pay your bill.

If you are in a tax payable position; once we lodge your business and individual tax returns with the ATO they will assess it and send out a Notice of Assessment. This is the trigger to pay your bill and the payment date will be on the Notice of Assessment. Depending on the business structure, the tax will be payable by the business or individuals.

Fear not, we can help. As your tax agent we can contact the ATO on your behalf and work as an intermediary to set up a payment plan that suits your cash flow. We do charge for this service, it is a flat fee of $99 to establish a payment plan for your ATO debt.

If you are in a tax refundable position; once we lodge your business and individual tax returns with the ATO you will receive any refunds due in approximately 14 days.

The polite thing to do is to call or email to let them know. But, you don’t have to. Under our ethical standards we will always advise your current accountant with an ethical letter letting them know we are taking you on as a new client. This is very common practice amongst accountants.

All tax returns and anything we do is in Australia. We do nothing overseas. We’re proudly owned and operated in Australia. We’re even listed on the Australian Stock Exchange (ASX:1CG). We try and automate as much as we can by linking directly into the ATO and hiring a team of tech experts to bring efficiency. That’s why we can provide great prices for lodging your tax return!

Sure! Our standard service is a web chat, but you are welcome to come into the office for the meetings. Your travel to come and see us is tax deductible too!

It’s true, we love numbers, we love tax, but that’s not why we’re here. We believe that the accounting profession hasn’t moved at the same rate as technology. We’ve bought the two together to automate all the non-value add tasks so we can apply our skills and expertise where they benefit you the most. This allows us to provide a low cost, high value solution to you, our customer. We want to make your financial life simple!

You can claim income protection insurance in your tax return as long as you have paid for it and not your superfund.

Your role is to keep your Xero file up to date and a One Click Life accountant will take care of the tax return lodgement.

An accountant at One Click Life will lodge your tax return for you. We just need you to keep your Xero file up to date during the year.

Lodging a business tax return is simple. Create an account with One Click Life and connect your business. We’ll take care of the rest!

Create an account with One Click Life and connect your business. We can then review and help you lodge your BAS online.

The easiest way to lodge a company tax return is using an online tax agent like One Click Life. Simply create a One Click Life account, connect your company and the accountants at One Click Life will take care of the rest.

A One Click Life accountant will lodge your tax return for you. We just need you to keep your Xero file up to date during the year.

As your tax agent a One Click Life accountant will lodge your tax return on your behalf. We just need you to keep your Xero file up to date during the year.

It’s simple to create an account with One Click Life and connect your business. Then you can sit back and leave the rest to your new Tax Agent, One Click Life. We review and help you lodge your business tax return online.

It’s simple to create an account with One Click Life and connect your company. Then you can sit back and leave the rest to your new Tax Agent, One Click Life. We review and help you lodge your company tax return online.

We get a heap of misspellings for ‘tax return’. A few of our favourites are tax retirn, tax returm, tax retirm and tax retyrn. Overseas the words ‘tax filing’ are used a lot also, so common phrases like file my tax return, tax return filing and tax filing are used where we might say lodge. Fun tax facts!

Latest Articles

-

These are the five dumbest things smart people waste money on

In a recent article for news.com.au, our CEO Mark Waller revealed the five “dumbest” things you … Read More

-

Microkeeper & One Click Life

At One Click Life, we’re always looking for ways to make tax time simple, and … Read More

-

What is Tax?

Want to learn a little bit about the Australian tax system, what tax is and … Read More

-

AIA Health June 2025 Offer

Join AIA by 30 June 2025 on an eligible policy and get up to $900 … Read More