What is HECS-HELP?

Prior to 2005 it was simply known as HECS, then they decided to change it up by adding ‘HELP’ on the end. HECS-HELP is a government-provided loan that you can apply for to help pay for your tertiary studies (university or other approved higher education).

If you’re an eligible student, the Australian government essentially pays the amount of the loan directly to your educational institution. It serves as both a loan and a student discount.

HECS Repayments: When do you start repaying your HECS student loan?

You start repaying your HECS-HELP debt when your repayment income (RI) reaches the minimum threshold set by the Australian Taxation Office. Put simply – when your yearly income reaches a certain amount, you have to start paying off your loan. For the 2020/21 financial year the minimum HECS threshold is $46,620. For 2021/22 it will go up to $47,014. These repayments are made through the tax system, but you also have the option to make voluntary repayments any time you want regardless of your income.

Your HECS-HELP repayment income is made up of the following amounts gathered from your income tax:

- Your total taxable income for the financial year

- Any amount your taxable income was reduced by investment loss

- Reportable fringe benefits

- Reportable super contributions

- Foreign employment income amounts from the current income year

Here are the 2020/21 HECS-HELP repayment thresholds and rates:

| 2020-2021 Repayment threshold | Repayment Rate |

| Below $46,620 | Nil |

| $46,620 – $53,826 | 1.0% |

| $53,827 – $57,055 | 2.0% |

| $57,056 – $60,479 | 2.5% |

| $60,480 – $64,108 | 3.0% |

| $64,109 – $67,954 | 3.5% |

| $67,955 – $72,031 | 4.0% |

| $72,032 – $76,354 | 4.5% |

| $76,355 – $80,935 | 5.0% |

| $80,936 – $85,792 | 5.5% |

| $85,793 – $90,939 | 6.0% |

| $90,940 – $96,396 | 6.5% |

| $96,397 – $102,179 | 7.0% |

| $102,180 – $108,309 | 7.5% |

| $108,310 – $114,707 | 8.0% |

| $114,708 – $121,698 | 8.5% |

| $121,699 – $128,999 | 9.0% |

| $129,000 – $136,739 | 9.5% |

| $136,740 and above | 10.0% |

How to check your HECS-HELP debt balance?

Wondering how much HECS-HELP you owe? There are a number of ways to see how much you’ve knocked off and what’s left to pay. ‘

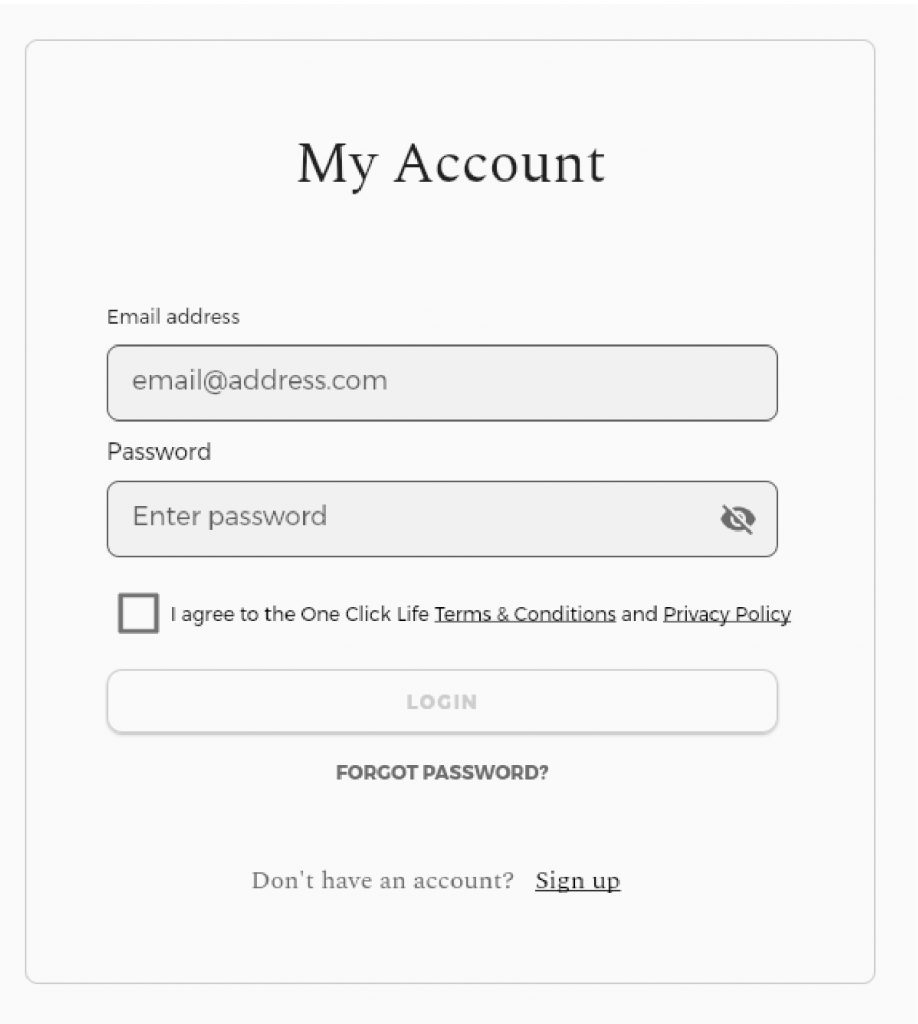

1. Log in to your OCL account

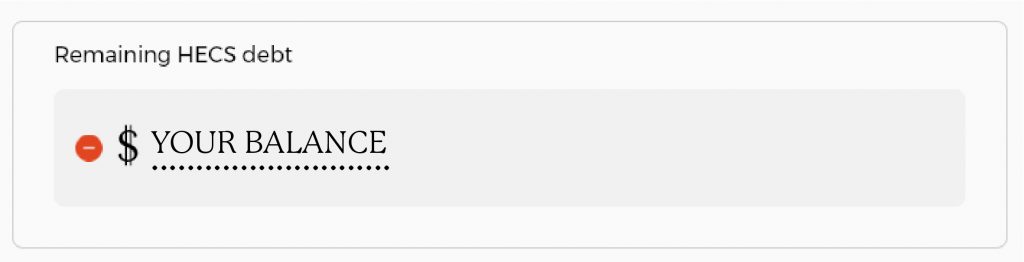

The joys of your One Click Life Life Admin dashboard – all of your info is at your fingertips within seconds. All it takes is 2 simple steps to check your balance:

STEP 1. LOG IN

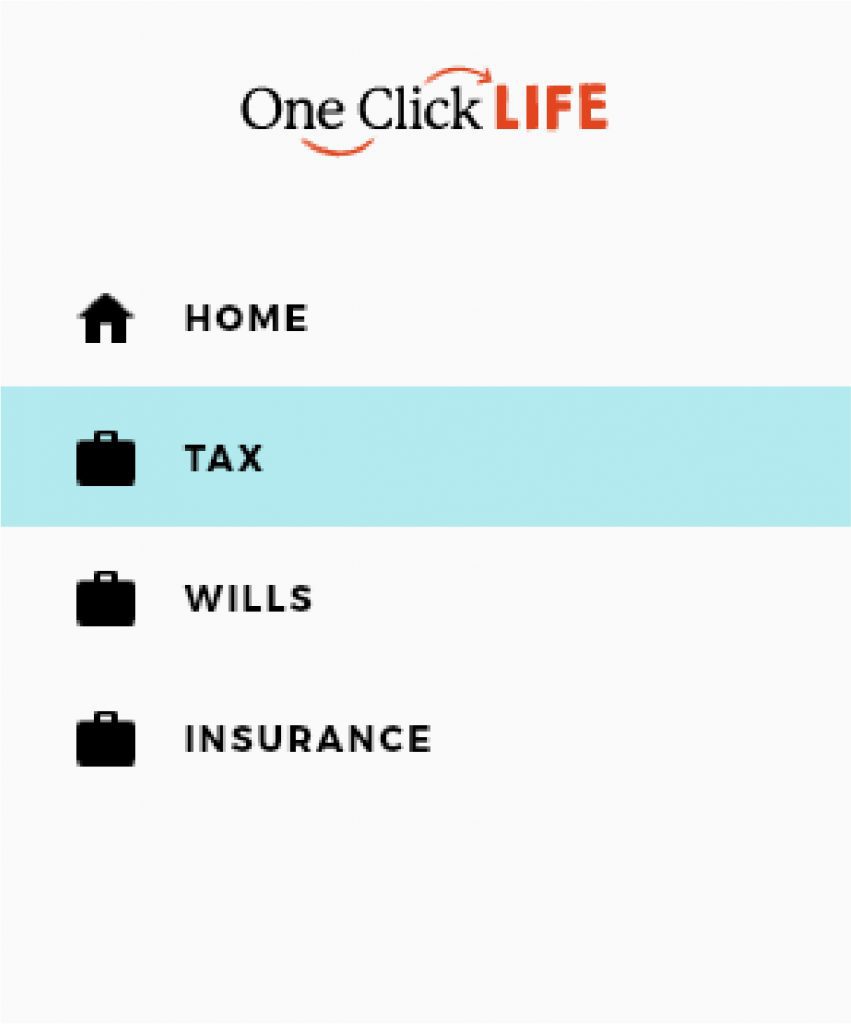

STEP 2. Click TAX on the side menu

VOILA! Your remaining HECS-HELP debt balance.

2. View your balance on myGov

If you’ve linked your myGov account to the ATO, you’ll be able to check your HECS-HELP debt any time just by logging into your myHELP account. You’ll also be able to view any other active or deferred government loans. But remember, you can log into your One Click Life dashboard and see all of your info quickly & easily, at any time!

3. Contact the ATO

You can call the ATO on 13 28 61 between the hours 8am to 6pm, Monday to Friday. They will be able to provide you with details relating to your HECS-HELP debt. As with all things Government, don’t be too surprised if you’re stuck waiting on hold for a while.

I am making repayments, why aren’t they showing?

While you might have weekly or fortnightly amounts coming out of your pay, the compulsory repayment on your HELP debt will only occur once you do your tax return.

How to repay your HECS-HELP debt through taxation system

There are two ways to pay off your HECS-HELP debt: compulsory repayments and voluntary repayments. As mentioned above, compulsory repayments are made once you earn above the minimum income threshold.

When starting a new job, you will be required to inform your employer that you have a HECS-HELP debt by ticking a box on the tax declaration form you complete before commencing work. Additional tax will be withheld from each pay to cover your HECS loan based on your annual repayment income.

Voluntary repayments can be made at any given time to the ATO using BPAY or credit card. *by logging into MyGov?

Should you pay your HECS loan off early?

This boils down to your income, expenses and circumstances. With any other kind of debt, your HECS-HELP loan will compound over time, but at a very low rate. There’s also no interest payable on your HELP debt, however, indexation is applied based on changes to cost of living, which was 0.6% in 2021.

Most loans have interest applied to them, which increases the total money repayable. However, HECS-HELP works differently – whereby the loan balance increases based on the increase in cost of living (inflation) This rate was 0.6% in 2021

Early HECS debt repayments will definitely make paying the loan off faster and will be a credit to your HECS-HELP balance, but that’s about it.

What factors should you consider before making early HECS repayments?

- What are your priorities — maybe you want to travel, maybe you’re saving for a car or a home loan deposit — what’s more important to you at this point in your life and career.

- Do you have any other forms of debt — most other types of loans, such as car loans, credit cards, home loans and personal loans usually have higher interest rates and compound much quicker over time. So, it would make sense to pay off these loans faster.

- Other investments — can you earn more money than the amount indexation applied on your HELP debt by investing your money elsewhere?

- Credit rating — although paying off higher interest loans is better for your credit rating, the bank will take into account your HECS debt or HELP debt when applying for a home loan and affect how much you’re able to loan out.

What happens if I can’t afford repayments?

If making your compulsory repayment will cause you serious financial hardship, you can apply to the ATO to defer your repayment.

Tips on how to repay help debt quickly

- Making voluntary repayments before 1st of June means you won’t be charged interest on the amount you just paid.

- If you’d like to make a big contribution or pay off your HECS-HELP debt, it is recommended to do so before you lodge your tax return. If you’re using One Click Life for your tax return, you can speak with our qualified accountants anytime over the phone or live chat, with no appointments.

- Contact – One Click Life

To Reduce the amount of help debt you pay at tax time

- Keep receipts and claim deductions on everything you can, as this will help reduce your repayment income and minimum compulsory yearly repayment amounts.

HECS Repayments: How to repay your HECS debt quickly – One Click Life

HECS Eligibility

How to know if you qualify for HECS-HELP:

- Must be studying in a Commonwealth support institution

- An Australian Citizen, or

- New Zealand category visa holder who meets long-term residency requirements, or

- Hold a permanent humanitarian visa,

- Enrolled in each unit at university by census date,

- Meet relevant HECS-HELP residency requirements

- Submit a valid request for Commonwealth support and HECS-HELP form by census date to your university

Do you still need to pay your HECS debt overseas?

Once upon a time, you did not have to repay anything while you were living overseas. This has since changed due to so many young Aussies traveling the world and working overseas for years at a time. You will have to make HECS debt repayments if you:

- Have a HECS/HELP debt

- Lived overseas for more than 6 continuous months

- Earn the equivalent income above the HELP repayment threshold ($46,620 2020/21)

What is HECS-HELP BENEFIT?

Previously, taxpayers who meet the relevant eligibility criteria could apply to the ATO for a HECS-HELP benefit where the ATO would pay up to $1,950 a year, if approved. This was created to provide an incentive for graduates in particular fields to pursue specific industry roles and/or work in specific locations. As of 2017, the HECS-HELP benefit was phased out.