Not claiming all your deductions is like leaving the ATO a tip at tax time! Read on to make sure you know what you can deduct this tax time so you’re not leaving the ATO a tip.

We want to you to get the maximum refund you’re entitled to by claiming all your hospitality tax deductions. Don’t leave anything out of your online tax return. If you save every little bit, and deduct everything you’re entitled to, the tax return can be massive.

Tax deductions are money you’ve spent to do your job. So, what money have most hospitality workers spent that they claim on tax? This blog explores exactly that!

When it comes down to it, there are three main criteria that qualifies an expense for tax deduction, which is calculated against your income:

- You must have spent the money and not have been reimbursed

- It must be related to your job

- You must have a record to prove it

However, this in itself can be hard to understand. What constitutes an expense as “related” to your job? Here is what defines your taxable income, and a list of deductions for hospitality workers.

Remember, a record isn’t necessarily a receipt. There are tax deductions you can claim without a receipt. Continue on to find out more.

What Is Your Taxable Income

Your taxable income is any money you get from your employer or your work. These things also include:

- PAYG summaries

- Pensions and government allowances

- Interest earned (banks etc)

- Dividends

- Rental property income

- Business income

- Other income earned (capital gains etc)

Hospitality Specific tax deductible expenses

- Buying any uniforms and clothing for your hospitality work

- The cost of laundry for clothes/uniforms that are worn for your job as a hospitality worker

- Protective clothing items that you use for your hospitality work (masks, hair nets, aprons, shoes, gloves etc)

- Purchase of equipment and tools used for your hospitality work (pens, notepads, knives, utensils if needed etc – you do not need a receipt if less than $300)

- Depreciation expense of equipment and tools over $300

- Leasing, repair and maintenance of work-related products and tools

- Interest generated from loans relating to work activities

- License, certification and courses that will improve your hospitality work (Approved manager certification, barista license, cooking course, waitress training, waitressing course, RSA etc)

- License renewal fees

- Work union fees/other similar organisations

- Subscriptions and magazines relating to your hospitality work

- Driving between two places of work in your own vehicle (conferences, moving between jobs, picking up stock and going to see customers / suppliers, driving from one workplace directly to another). This is usually best claimed using the cents per km method of claiming a tax deduction.

Here’s a list of general expenses that may be applicable to you;

- Car expenses and wear (estimated Km or a logbook with all expense items)

- Travel expenses (flights, taxis and trains etc)

- Accommodation for work related reasons (including meals)

- Work phone expenses

- Work related (as a percentage if shared with personal use) for computing

- Home office expenses that relate to work

- Last year’s tax return fee

- Insurance

- Rental property expense (if you are renting)

- Charity donations

- Sunglasses and sunscreen (if you have to work outside)

There will be more hospitality staff tax benefits and tax deductions that aren’t on this list. Tax deductions are not only industry specific, but also change from individual to individual.

Buying Your Hospitality Clothing

For you to be able to deduct your hospitality clothing, both to buy and to put in the laundry, it has to have your work logo/name on it. Luckily, most hospitality worker clothes usually have this.

Protective Clothing For Hospitality Staff

If you need to buy any protective clothing, you can claim that back as a tax deduction. Bartender shoes, or any non-slip shoes for hospitality workers, face masks, gloves, and hair nets are all tax deductible.

Joining A Union

Joining a union is a popular thing for hospitality workers. Can you claim union fees back on tax? The answer is yes.

Licenses and Trainings

Hospitality management and staff can claim any license or training they get that will help with their work as a tax deduction. They can’t claim the initial buy-in cost, but they can claim any cost it takes to renew it.

Can’t find all your receipts? No stress!!

Simple Accounting Manager (SAM) is a free feature exclusive to One Click Life. With access to the 4 major banks + over 100 other financial institutions, we can securely connect directly to your bank account and get a list of all necessary deductions to maximise your refund! It’s that simple.

Maximising Your Tax Return With One Click Life

The best way to claim the most you can is with a tax agent like One Click Life. We have made the process simple with 5 easy steps:

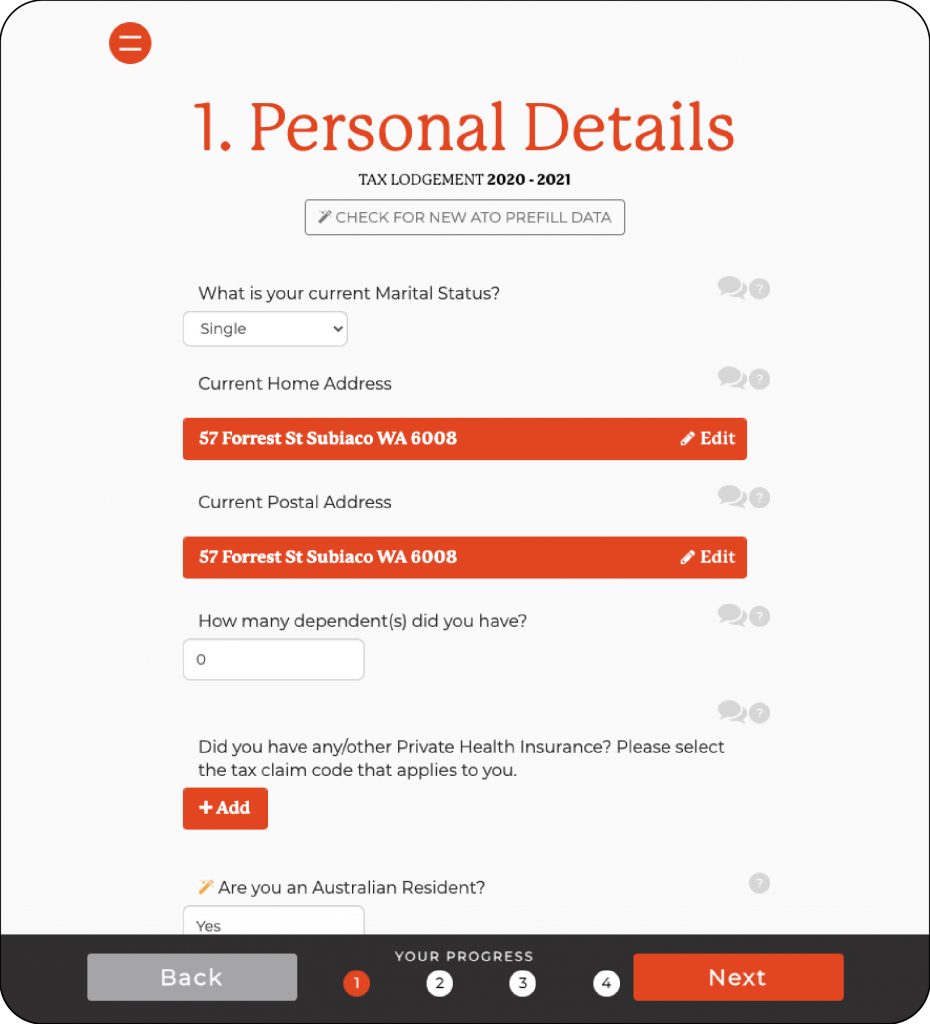

STEP 1: Personal Details

- Your personal details are automatically pre-filled from ATO records

- Confirm and edit your address if needed

- Confirm, edit or add Private Health Insurances

- If you get stuck at any stage, you can speak to a friendly expert using live chat, or over the phone.

Hit next to go to the Income page.

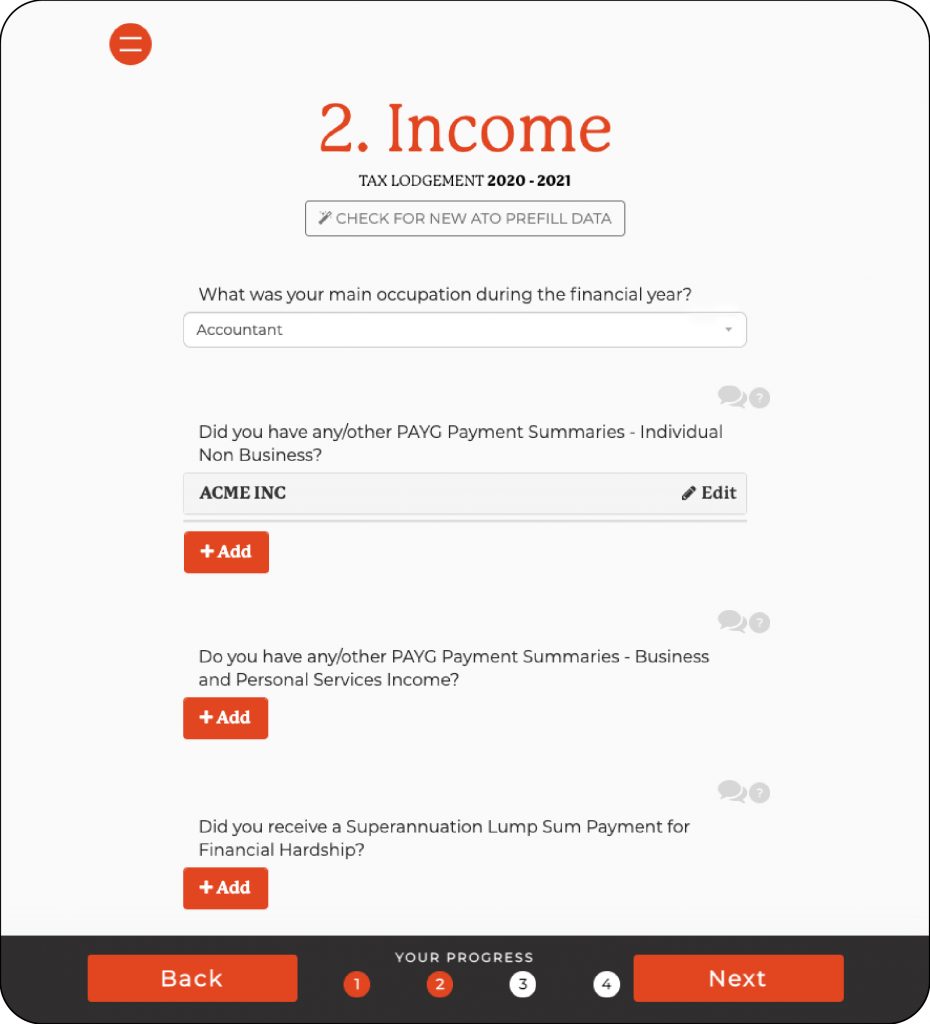

STEP 2: Income

This is an important step to consider, as it will have a direct impact on getting you a better tax refund. The ATO also requires you to provide at least one occupation.

- Select your occupation for quick and easy pre-populated deductions on the next screen. Confirm and edit your address if needed

- Have additional income or PAYG payment summaries? Simply click the Add button.

- Not sure what you need to add? Speak to a real accountant on live chat by clicking the speech bubbles, or over the phone for quick and easy guidance.

Wondering what are the tax deductions you can claim on taxes? Let’s move onto the deductions screen.

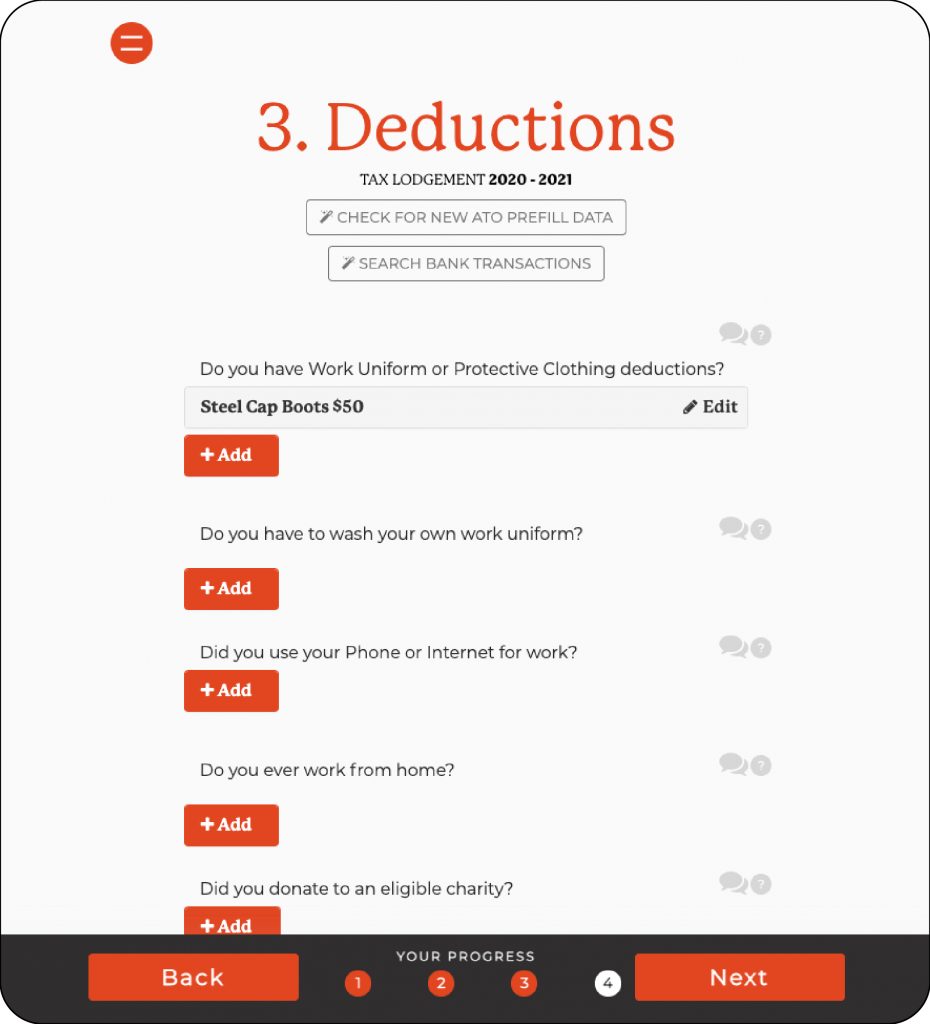

STEP 3: Deductions

It’s time to maximize your Tax Return. Now, if you selected your occupation on the Income page, you will see how easy it is to add tax deductible items.

- A list of pre-populated deductions that are common for your occupation are automatically suggested.

- All you have to do is click the Add button to add deductions that apply to you, making it a super quick simple process!

- To make things even easier, the “Search Bank Transactions” at the top of the page means we’ll find all claimable transactions without you having to dig around for receipts.

- Safe, secure and protected. We’ll never store your bank credentials or store your transactions.

- Not sure what you can claim on tax? Jump on a call with a real accountant, or hop on live chat for guidance while doing your Tax Return

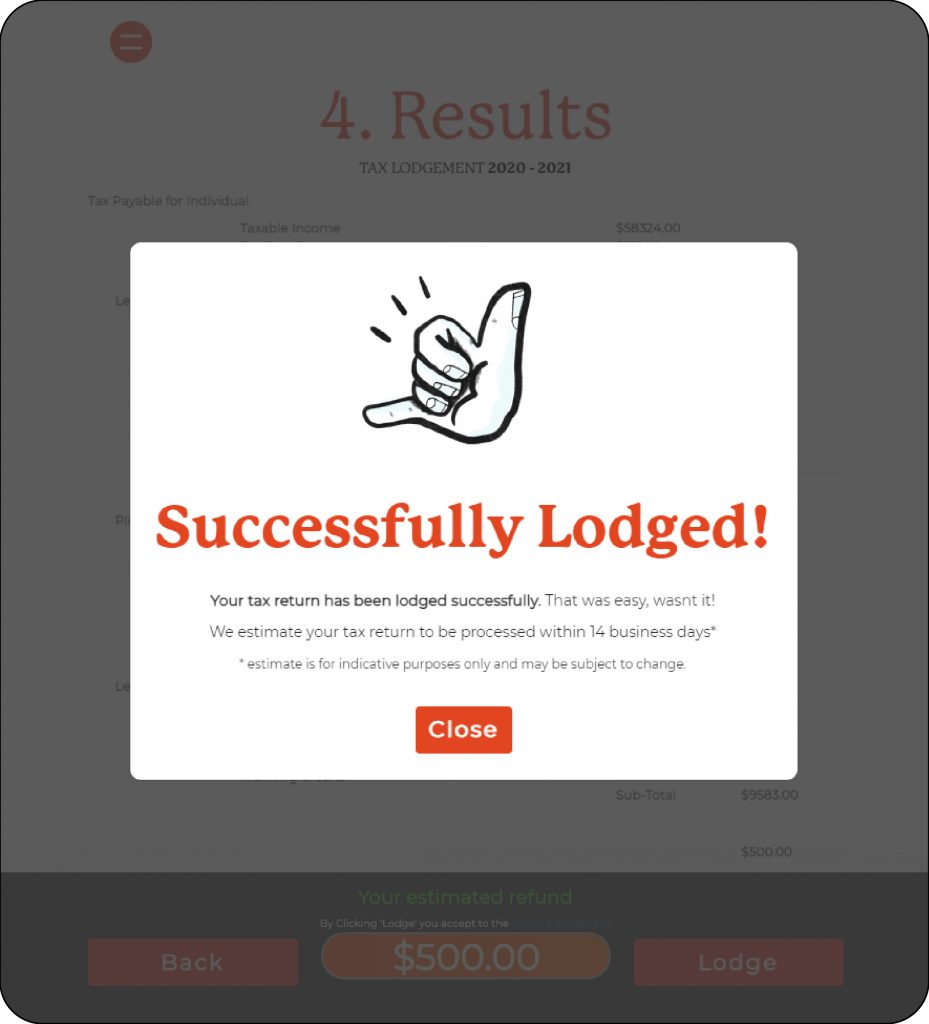

STEP 4: Results

Based on all the information you have selected in prior steps, you may now view your estimated Tax Return before it is lodged.

- Something doesn’t add up? Not happy with your Return? Speak with a friendly tax accountant to make sure you’re getting the best tax refund.

It’s time to lodge your Tax Return online and get that refund into your bank account as fast as possible!

STEP 5: Congratulations! You just completed your Tax Return.

How easy was that? You can now see why 98.1% of our customers love using One Click Life to do their Tax Returns online.

- Your refunds will be deposited into the bank account shown. Make sure these details are correct to avoid any tax refund delays.

- Our qualified tax accountants will review your Tax Return one last time to make sure everything is correct so you aren’t bothered by the ATO. If something isn’t right, we’ll get in contact with you immediately.

- Click Complete Lodgement to get your tax refund faster.

Need help with lodging your Tax Return online for the first time?

No need to be nervous about submitting a Tax Return online. You can contact our friendly numbers geeks (expert accountants) anytime throughout the whole process.

You will also receive an email notification sent to your inbox or you can access notifications via the side menu on the One Click Life app. Simply click ‘Notifications’ and then click ‘View Message’.

1300 707 117

Also, check out the OCL Life Admin Hub where you’ll find a wide range of blogs, resources, news and tips to help you tackle the unavoidable part of life that is adulting, including all things Tax!