This article will give you an idea of what the tax percentage is in Australia during the 2023-24 financial year. In this blog, we will cover a tax overview, the Medicare levy, and the different 2024 tax brackets that are used in Australia. You’ll pay a different rate of tax depending on one of the following situations you follow:

- Resident tax rate

- Non-resident tax rates

- Working Holiday tax rates

Tax overview

Taxes paid by individuals and corporations to the government in Australia are used to pay for public services and goods including national defence, infrastructure, and education.

Although tax rates can change between years, the 2024 tax brackets remain unchanged compared to 2023 tax brackets.

What is the Medicare levy?

The Australian government imposes the Medicare levy to fund the public healthcare system, called Medicare. Currently, the Medicare levy is set at 2% of an individual’s income, with the money being used to help relieve costs associated with medical services in Australia.

Example: Jane earns $70,000 for the financial year. Jane will be required to pay $1,400 ($70,000 x 2%) for the Medicare levy over and above her income tax bracket rates.

You do not need to pay the Medicare Levy if you are a resident and you earn less than the tax free threshold.

Tax Free Threshold

The tax free threshold is the amount you can earn as an Australian resident before you have to pay tax in Australia. In 2024 the tax free threshold is $18,200.

Put simply, what is the tax free threshold? Tax free money!

The tax-free threshold Is displayed below for earnings on a weekly, fortnightly, monthly basis:

Resident 2024 tax rates

What is a resident for tax purposes?

A person who resides in Australia has a permanent residence there and spends more than half of the income year there is considered a resident for tax reasons.

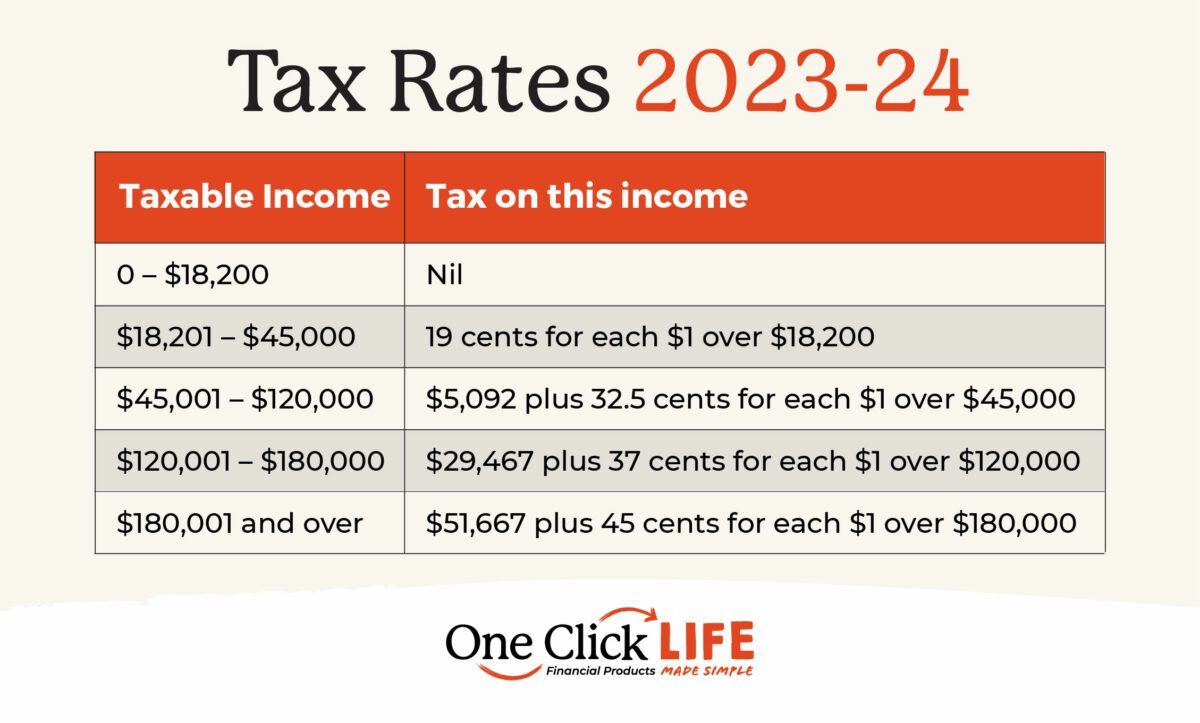

The following lists the resident 2024 tax rates.

| Taxable income | Tax on this income in 2024 |

| 0 – $18,200 | Nil |

| $18,201 – $45,000 | 19 cents for each $1 over $18,200 |

| $45,001 – $120,000 | $5,092 plus 32.5 cents for each $1 over $45,000 |

| $120,001 – $180,000 | $29,467 plus 37 cents for each $1 over $120,000 |

| $180,001 and over | $51,667 plus 45 cents for each $1 over $180,000 |

Example: Sam is a resident that earns $80,000 kn the 2024 financial year. To work out Sam’s tax payable first we select the tax bracket Sam’s earnings appear in. We can see that Sam will be required to pay $5,092 and 32.5c for every $1 over $45,000.

Sam earns $35,000 ($80,000 – $45,000) over $45,000, so she will pay $11,375 ($35,000 x 32.5 cents) in tax in 2024.

By adding the $11,375 and $5,092, from the prior 2024 tax bracket, we get Sam’s income tax payable of $16,467 for the year.

Including the Medicare levy of 2% ($80,000 x 2% = $1,600), Sam has a total tax payable of $18,067 in 2024.

Foreign resident 2024 tax rates

What is a foreign resident for tax purposes?

A non-tax resident is referred to as a foreign resident. In essence, it is everyone who is not regarded as a resident for tax purposes.

The following lists the non-resident 2024 tax rates.

| Taxable income | Tax on this income |

| 0 – $120,000 | 32.5 cents for each $1 |

| $120,001 – $180,000 | $39,000 plus 37 cents for each $1 over $120,000 |

| $180,001 and over | $61,200 plus 45 cents for each $1 over $180,000 |

Example: Dale is a foreign resident and earns $80,000 in Australia in the 2024 financial year. Dale is required to pay 32.5 cents for each $1.

$80,000 x 32.5 cents = $26,000

As foreign residents are exempt from paying the Medicare levy, David’s total tax payable is $26,000.

Working Holiday Maker (WHM) 2024 tax rates

What is a Working Holiday Maker for tax purposes?

Young adults can travel to Australia for a year on a 12-month vacation under a programme run by the Australian government, however, they must work part-time during the trip. Working Holiday Makers are people who work in these circumstances.

A Working Holiday Maker also has certain employment conditions that can be found on the immigration website.

The following list includes the working holiday maker tax rates.

| Taxable income | Tax on this income |

| 0 – $45,000 | 15% |

| $45,001 – $120,000 | $6,750 plus 32.5 cents for each $1 over $45,000 |

| $120,001 – $180,000 | $31,125 plus 37 cents for each $1 over $120,000 |

| $180,001 and over | $53,325 plus 45 cents for each $1 over $180,000 |

Example: Callum is a Working Holiday Maker, and he earns $80,000 while he is in Australia in 2024. Callum is required to pay $6,750 based on the prior tax bracket plus 32.5 cents for each $1 over $45,000.

Callum earns $35,000 over $45,000 ($80,000 – $45,000), so he is required to pay $11,375 ($35,000 x 32.5 cents) in that tax bracket.

By adding $6,750 and $11,375 tax from the two tax brackets, Callum has an income tax payable of $18,125 in 2024.

As Working Holiday Makers are not required to pay the Medicare levy, John has a total tax payable of $18,125 in 2024.

Use an online tax calculator!

Quickly calculate your own taxes, without the hassle of calculating them yourself by using One Click Life’s online tax calculator. One Click Life is an online tax adviser, that ensures that you get the most out of your tax return.