Looking for a simple way to do a tax return in Australia?

This page sets out:

· How to lodge a tax return in Australia,

· The easiest way to lodge a tax return in Australia, and

· How to pay your tax at the ATO if you have a tax bill.

As an added bonus, we’ve included a few tax hacks to increase your refund!

How to lodge a tax return in Australia

There are 3 ways to complete a tax return.

- Use a simple online tax return like One Click Life

- Find a local accountant, book an appointment, find all your information then wait at reception… this isn’t sounding very appealing is it?

- Use the ATO. Create a MyGov account, work out how to identify yourself. Create a MyTax account. Link MyTax to MyGov. Work out how to use MyTax. It’s not too hard if you have a laptop handy.

If you’re like the hundreds of thousands of people that want to lodge a simple tax return in under ten minutes from your mobile phone, read on!

The easiest way to lodge a tax return – One Click Life

If you want to lodge your tax return in under ten minutes, from your mobile phone, then set up a free account with One Click Life. This is the easiest way to lodge your own tax return in Australia.

Create free account nowStep 1 – create a free One Click Life account (1 minute)

This is simple and gives you access to check out your tax returns, download tax returns, download your Notice of Assessment, see your HECS / HELP balance and much more!

Step 2 – verify your identity (1 minute)

You have an account with One Click Life at this point, but before you can complete your online tax return we need to verify your identity. This is simple and automated and you can use your license, passport or upload manually with alternative forms of Identification if you need to.

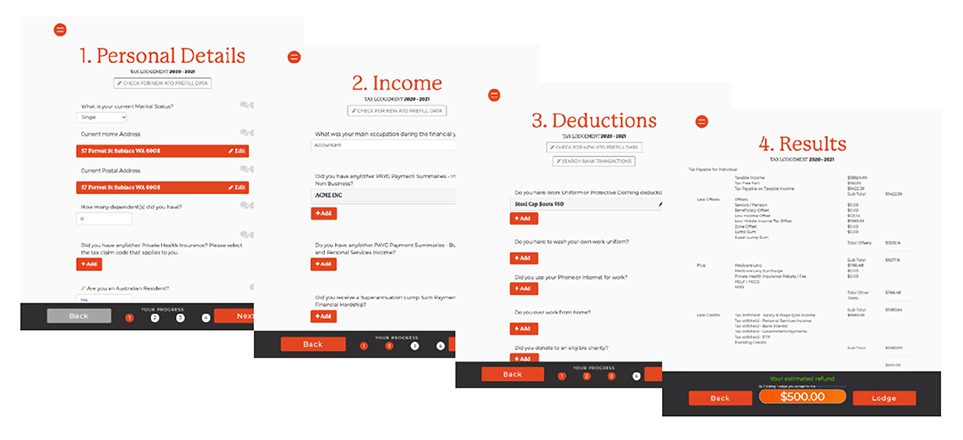

Step 3 – Open your online tax return and file (2 minutes)

In background while you created your One Click Life account and verified your identity our clever AI tool that we call SAM has collated all your information that was at the ATO and entered it in your online tax return for you.

Now you can add in your tax deductions. Tax deductions will increase your tax refund. The easiest way to do this is to do this is connecting your bank account to One Click Life. Alternatively, manually enter them.

Check out this blog post for tips on deductions.

Step 4 – Review your online tax return and lodge! (1 minute)

Congratulations! You’ve completed your online tax return. The last part of the journey is hitting a big button called LODGE!

Once you hit lodge your online tax return makes its way to the ATO and you’re all done for another year. At this step you can select whether to pay our bill or have it taken out of your tax return.

Now we know how to lodge an online tax return in 5 minutes and you also know why One Click Life is the best online tax return Australia. It is easy and fast to file tax online with One Click Life.

What to do if you’re lost and need help with your Tax Return?

If you need a hand of feel that something just isn’t right, it’s free to call up and speak to a tax agent at One Click Life. When you lodge your tax return in Australia with One Click Life, you get access to a heap of free tools to manage your financial life, including all year support with your tax. Call us on 1300 707 117 to talk tax.

How to pay your Tax in Australia

Your taxes are withheld from your wages by your employer and remitted to the ATO on a monthly basis. This makes your annual tax return a reconciliation of your tax position. The tax return will result in one of three outcomes:

1. Nil tax payable

If you didn’t pay any tax during the year, you will not receive any back at time. Also, if you didn’t work during the year, you won’t receive any tax back. We call this a ‘nil return’. Although it is a nil return, it still needs to be reported by to the ATO by lodging your nil return.

2. Tax Refundable

This is the most common position. This is when the ATO give you back some of the tax that your employer remitted to the ATO from your wages. To receive your tax refund, you need to include your correct bank details on your tax return.

3. Tax Payable

Where you have not paid enough tax from your wages throughout the year, you will end up in a tax payable position. Once you lodge your tax return, the ATO will provide a Notice of Assessment with payment details. The easiest way to pay, is via bpay.

What is a Notice of Assessment?

Approximately 14-21 days after you lodge your tax return, you will receive a Notice of Assessment from the ATO. This is a record of how the ATO has assessed your tax return based on the information you have provided when you lodged your tax return.

This can be accessed for free from your One Click Life account. Just navigate to “ATO Docs” and select the year you would like to view.

Tax Hacks!

Tax Hack #1 – Use your tax-free threshold wisely

To ensure you are not in a taxable position at the end of the year, only claim the tax-free threshold from one employer at a time. This means that your second employer will tax you a little more than your main employer, but better not to be in a tax payable position come tax time.

Tax Hack #2 – Claim your tax deductions

Claim all the tax deductions you are entitled to. Tax deductions reduce your taxable income and therefore the amount of tax you need to pay. Make sure that the deductions you claim were paid for by you, are related to earning your taxable income, you have a receipt for the expenditure and you were not reimbursed by your employer.

Tax Hack #3 – Tax deductions with no receipts

There are a number of tax deductions that you can claim even if you don’t have any receipts. Check out our full blog here for more information. The key tax deductions you can claim without receipts are:

- Laundry of your work uniform or protective clothing (up to $150).

- Working from home hourly rate method ($0.70 per hour you worked from home).

- Driving your own car for work related purposes ($0.88 per kilometre travelled) excluding driving to and from work. This is called the cents per kilometre method.

Tax Hack #4 – Accessing your Group Certificate easily

To access your Group Certificate easily you can simply open your tax return in One Click Life and see your group certificate (also known as a payment summary) already in your tax return. This is the easiest way to see your annual Group Certificate.

Tax Hack #5 – One Click Life fees are tax deductible

When you use One Click Life to lodge your tax return, your fees are tax deductible. This means using One Click Life actually increases your tax refund for the next year!

Tax Hack #6 – Spend your refund wisely!

You can use your tax refund wisely to get ahead. Here’s a few productive ways to spend your tax refund;

- If you have a mortgage, park it in your offset account or pay it off the balance to save on interest.

- Invest in your future by contributing to superannuation. This is also tax deductible so increases your refund for next year.

- Invest in shares or ETFs. Building up a portfolio of investments for longer term benefits.

- Create an emergency fund using a high interest account with your bank to save for a rainy day.

- Pay off your credit cards or other high interest loans.

But…. If your mental health needs a bit of TLC, then a little holiday is also nice!

One Click Life – Your financial life made easy

We’ve built a financial life platform to make managing your financial life simple. The better we can make your financial life, the easier your whole life!

On One Click Life you can lodge an online tax return, create an online Will, get assistance with lending and sort your insurance.

Create a free account today to learn more!

Create free account now