Let’s get this straight so there is no confusion. Medical expenses are no longer tax deductible.Tax deductions on medical expenses once offered Australians financial relief for a period. However, medical expense tax offsets were only available between 2014-15 to 2018-19.

This blog may benefit you if you have an outstanding tax return between 2015 to 2019, and you would like to claim tax deductions on medical expenses. This article will answer what medical expenses are tax deductible, what medical expenses are not tax deductible, and how can you claim medical expenses on a previous year’s tax return.

What medical expenses are tax deductible?

During the 2015-16 to 2018-19 period, only certain medical expenses were tax deductible. Please note that these expenses are no longer available today.

Medical expenses that were tax deductible had to fall under the following categories:

- Disability aids

- Attendant care

- Aged care

If you received a refund from any entity such as insurers or government programs, for your medical expenses, you could only claim the non-reimbursed expense.

Total medical expense – Refund amount = Net expenses to claim

What medical expenses are not tax deductible?

After the 2018-19 financial year, all medical expenses are no longer tax deductible. If you are lodging a tax return between the 2015-16 to 2018-19 financial years, medical expenses that do not relate to disability aids, attendant care, and aged care, are not deductible.

For example, you cannot claim the following:

- Life insurance premiums

- Cosmetic surgeries

- Pre-employment medicals

How can you claim medical expenses on a previous year’s tax return?

If you have an outstanding tax return between the 2015-16 to 2018-19 period, you can use the One Click Life platform to claim eligible medical expenses. You are still required to have a record of your medical expenses from the period to claim your medical expense tax offsets.

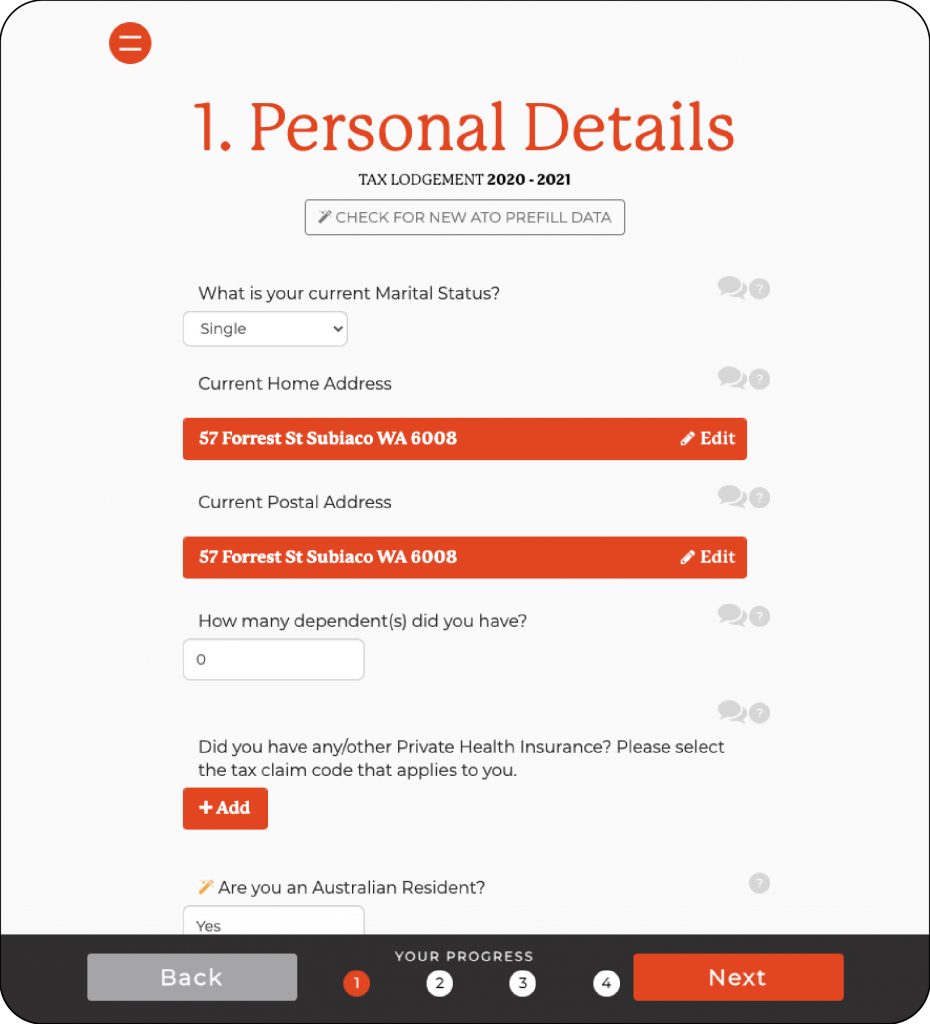

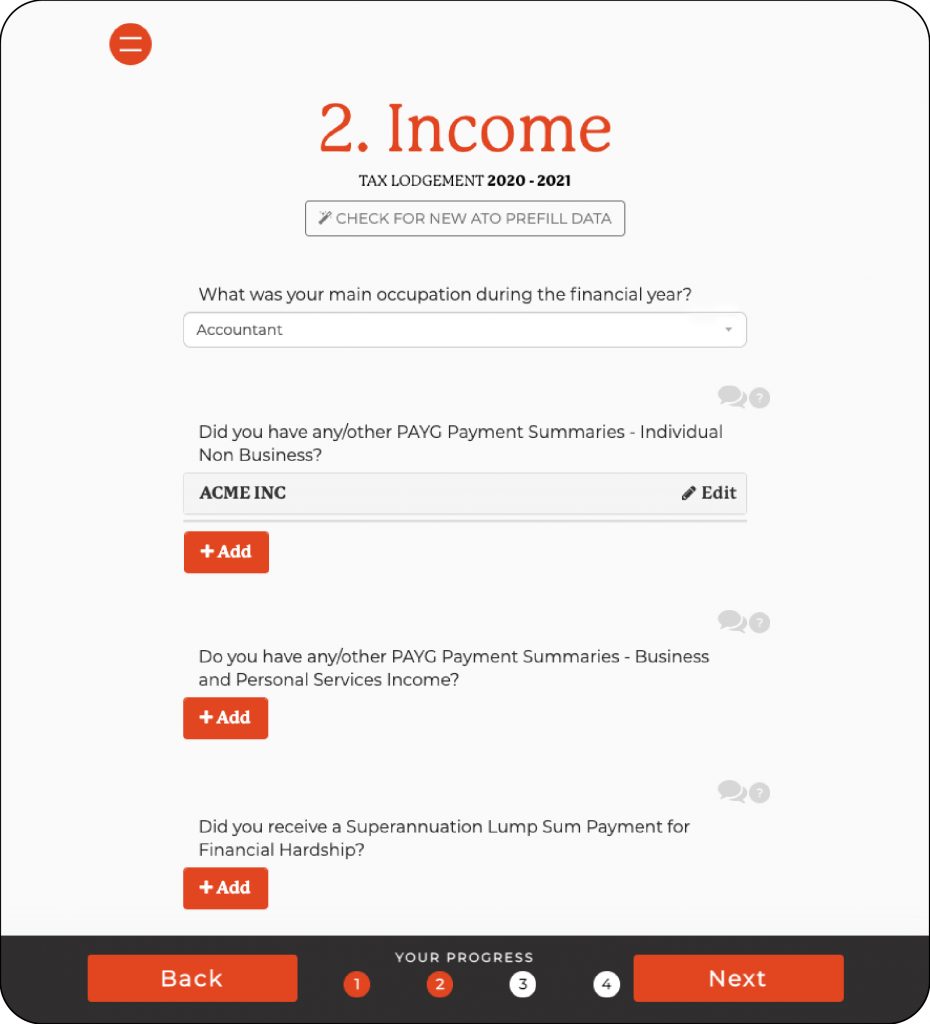

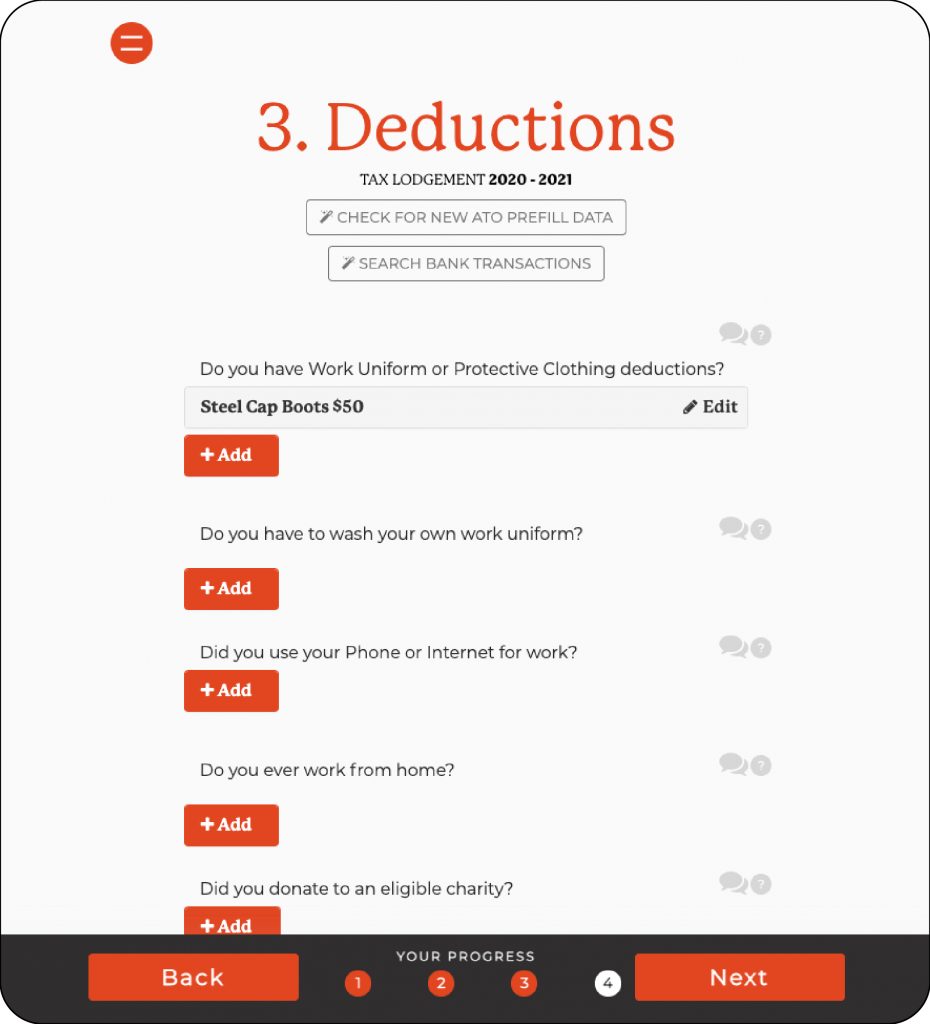

When you log in to the One Click Life platform, you will see if you have any overdue tax returns. If that is the case, click on “lodge” to get started. Lodging your overdue tax return can be done in 4 simple steps:

- Enter your personal details.

- Fill out your occupation and income details.

- Enter all your deductions.

- Results: Your estimated tax return will appear. Check over the information and click “Lodge” when you are happy, to lodge your return.

- Once you’re ready to go, send us a message and let us know your medical expenses. We’ll review and let you know if there is an opportunity to claim them and enter them in for you.

Online Tax Return

Online tax returns allow you to very easily and quickly lodge your tax return direct to the ATO. An online tax return can be completed from your mobile phone and using One Click Life, this can all happen in about 5 minutes!

Our online tax return technology is plugged in directly to the ATO which makes its filing your tax return easy. All your personal details and income details are prepopulated in the tax return as you start so most of the job is reviewing accurate information with more than half the tax return already completed for you!

All you need to do is add in your tax deductions. Simple!

(but remember not to add in tax deductions on medical expenses, these have finished!)

Get rid of your overdue Tax Returns using One Click Life!

Do you have outstanding tax returns? One Click Life is an online tax agent that makes it simple to complete your tax return. That means you can quickly wipe out all your overdue taxes in one place.

One Click Life offers a unique experience run by a group of friendly accountants that provides tax returns with the click of a button. Do more of the things you enjoy in life by letting us deal with all your life admin. We make it easy to track your Taxes, Mortgages, and Private Health Insurance in a single place.

This article is for general information only. It does not make recommendations, nor does it provide advice to address your personal circumstances. To make an informed decision, always contact a registered tax professional.