Are you struggling with completing your individual, sole trader or business tax return? We are here to help you to turn it into a very simple tax return process.

We understand that TAX IS NOT FOR EVERYONE. For this, we have created a simple system for you to have a go (with instructions included!).

You can complete and lodge your tax return to Australian Taxation Office (ATO) in your own time and in the comfort of your home. However, if you are struck with anything, we have friendly tax accountants to assist you during business hours. So, no worries, we got your back!

Why should you do your tax return with us?

- Quick and easy system:

With a simple system we have created, it will be so quick and easy that you can complete your tax return within 5 minutes! - Prefill:

Our system is able to pre-fill all of your reported income and private health insurance details. All you have to do is to double check your income and add your deductions into the system. - No Appointment Needed:

Don’t worry if you are only free on the weekend, you can do your tax return at your own convenience, at any time of the day, wherever you may be. No appointment is required! - Support:

We have our friendly tax accountants to support you during business hours, if you are stuck with anything. We are here for you! - Estimated Refund:

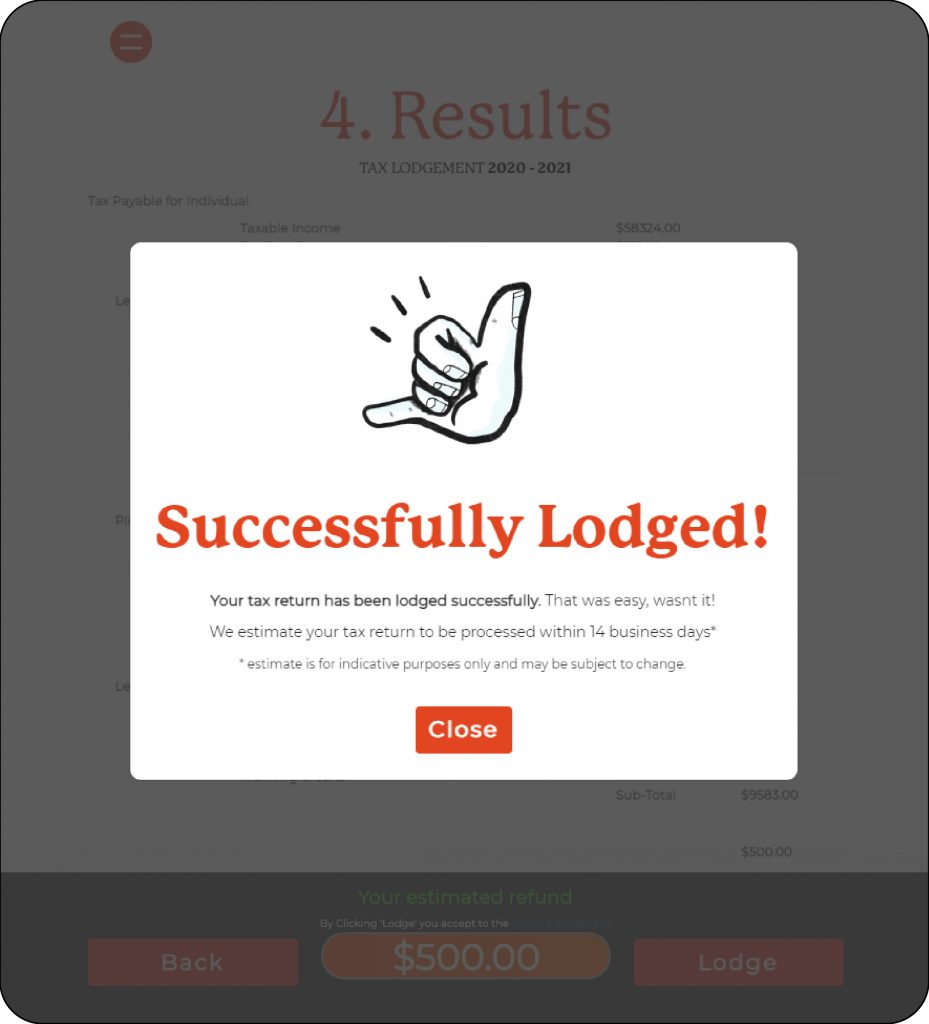

Before you lodge your tax return, you will be able to see your estimated refund/payable.

You can also click back to edit any information before you confirm and lodge. - Deductible Accounting Fees:

Accounting fees are a deductible expense, so why struggle and do it yourself?

Tax return process

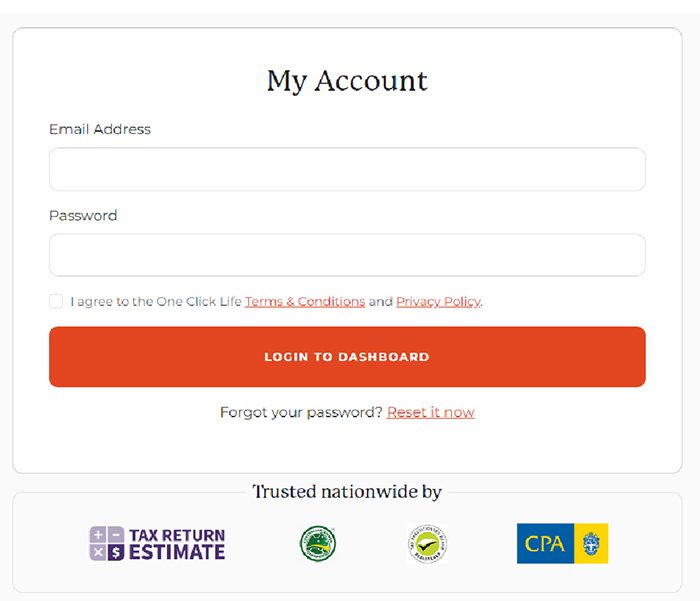

- Log In:

Create your account with ONECLICKTAX or log back into ONECLICKTAX - Tax Return:

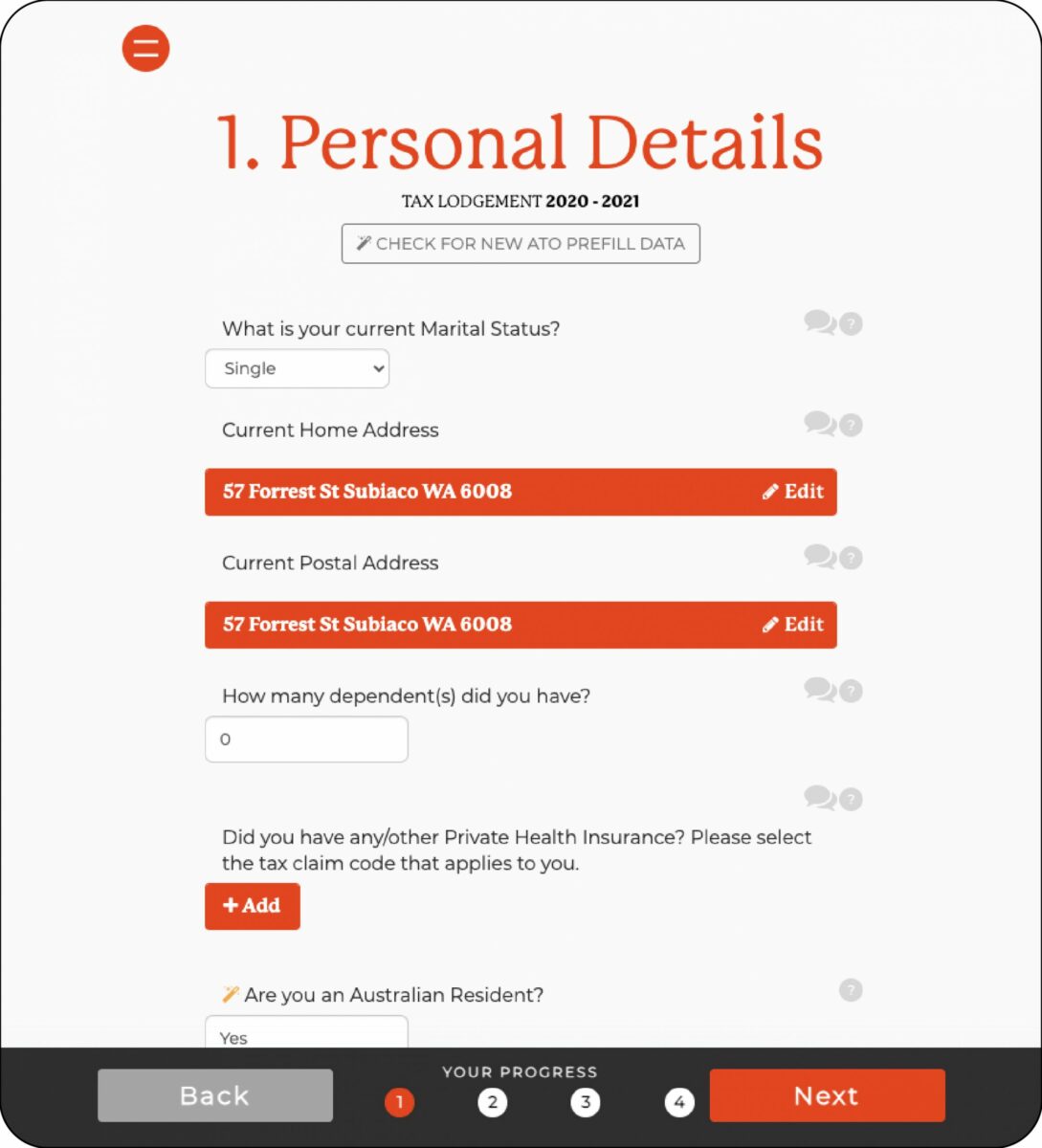

Select the year that you want to complete your tax return - First Page:

Enter your personal details (the system will prefill your private health insurance details for you) - Second Page:

Our system will prefill your reported income into the income page for you. All you have to do is to double check if there is anything missing or that shouldn’t be there.

However, for Sole Trader, your will need to add your total income and expenses by yourself - Third Page:

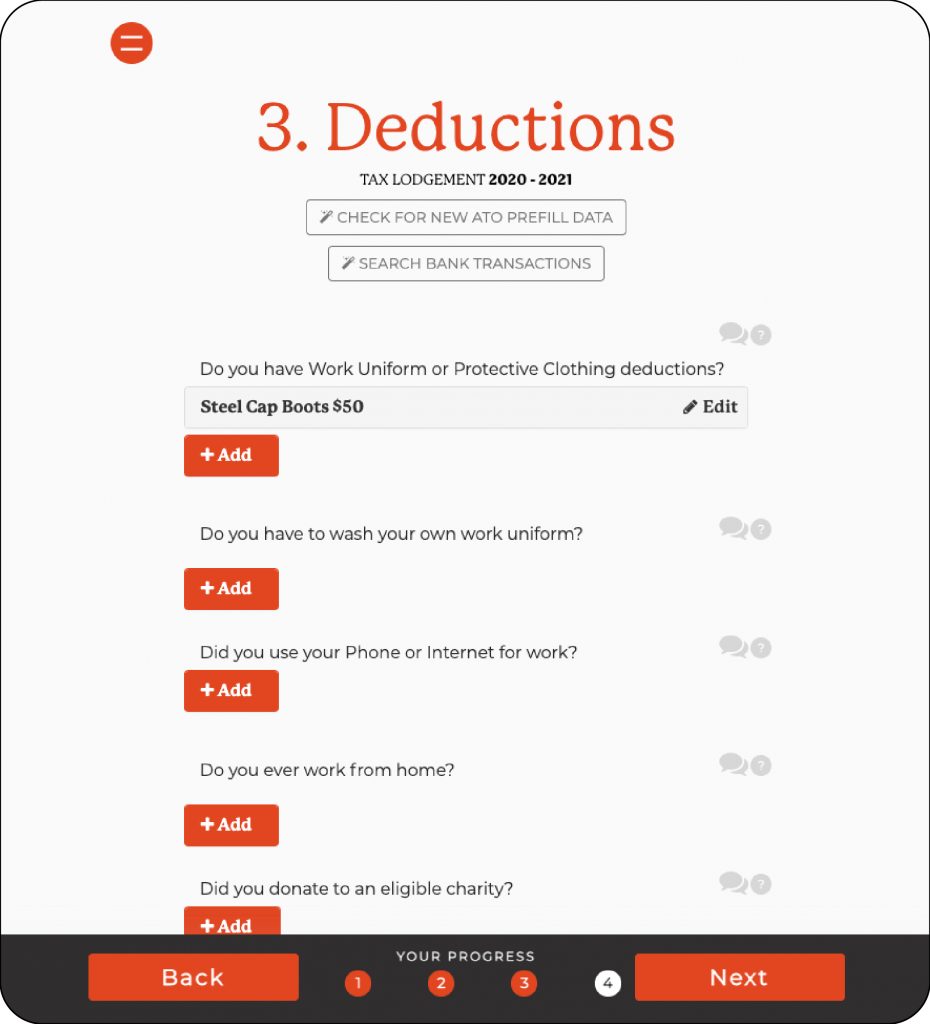

Add your deductions! Here you will input expenses you incurred for work. Not to worry, we have placed some suggestions and prompts for potential deductions that you can claim! - Fourth Page:

The system will calculate an estimated refund/payable for you to review.

Once you are happy with the amount, you can proceed to pay and add your bank details that you want your refund to be transferred to, after the ATO assess your tax return.

Our system is quick and easy, you can actually complete your tax return within 5 minutes!!

Step one

Sign up or log back to our website

Step two

Confirm your details

Step three

Manage your income and deductions

Step four

Enter your bank details and lodge!