Most of us know all too well how deflating it is to work hard all week then have most of your pay disappear on tax, groceries, rent, bills, & loan repayments. If you’ve completed your Tax Return this year and have arrived on the lodgement page only to discover red numbers in front of you, you may also be getting an additional Tax Debt to add to the list. It’s understandable that another hit to the wallet might be unwelcome, so whilst you might just want to turn off and ignore it, it’s really important that you don’t ignore your tax debt.

Why can’t you ignore your Tax Debt

Two main reasons;

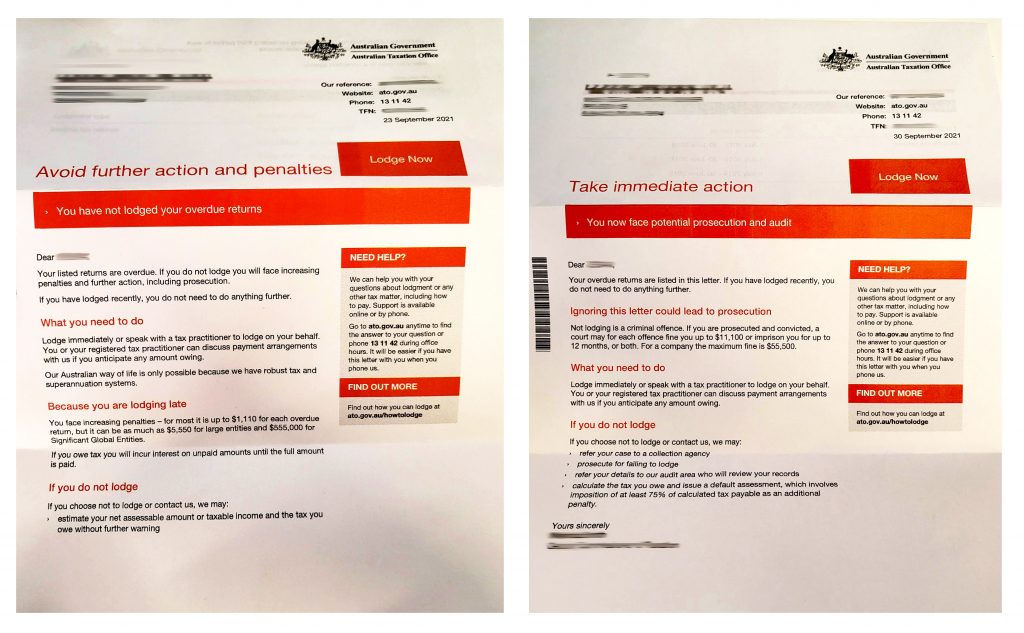

- You can be fined. (Making the tax bill even higher!) You can also be charged interest on your debt on top of these fines. More info on Failure to Lodge Penalty figures HERE

- Not lodging your Tax Return is a criminal offence. This can lead to prosecution and conviction and can even result in being fined up to $11,000 or prison for up to 12 months! EEEK!

Can you avoid lodging if you have a Tax Debt?

We get asked all the time if you can avoid lodging if you’re in a tax payable position, but this is not advisable. You still need to lodge your tax return by the due date. For most people that is 31 October each year, but for some this can be as late as the 15th of May. Check out our blog on last dates for tax lodgement here.

What are your options if you have a Tax Debt

If you’ve got the money it’s simple – Pay your tax bill. This gets the ATO of your back and leaves you with that warm fuzzy feeling that the debt collectors won’t be knocking at the door.

If that’s not possible, no need to stress out. If you’re having trouble paying your Tax Debt in one hit, you can contact the ATO and organise a payment plan. Alternatively One Click Life – your friendly tax agent, can assist you by organising a payment plan for you. You can then pay off your Tax Debt in instalments.

How to avoid Tax Debt next year

Unfortunately, if you earn the same amount next year as you did this year, in the same way, it’s likely you’re going to owe the ATO money again and you need to make some changes. Check out our list of tax management strategies below:

- Speak to your employer. If you’re an employee and you’re in a tax payable position, it’s likely that you have filled in your tax declaration incorrectly. Request a copy from your employer and check that it is accurate. The two key things to get right here are:

- Only claim the tax free threshold from one employer.

- If you have a HECS bill from your studies, make sure you have ticked this box.

- Medicare Levy Surcharge might be causing the problem. Review whether you are paying the Medicare Levy Surcharge and if you are, look into taking out private health insurance.

- Centrelink income isn’t taxed. If you have earned money during the year and Centrelink, quite often we see not enough tax being set aside. If you move from Centrelink income to earning a wage, make sure you keep a little bit of money aside to avoid being short if you’re in a tax payable position. Alternatively, request that the government tax your Centrelink income.

- Put some money aside. Use last year’s income statement to see what your total income was. If you expect your income to be the same this year, it’s simple. Get the Tax Debt figure & divide it by 52 – then put that much money aside every week. Come tax time, you’ll have that money sitting there ready to go.

- Try to reduce your taxable Income – not your earnings! There are a number of ways you could potentially reduce the amount of tax you pay each year including claiming tax deductions, certain tax offsets, and/or choose to salary package (salary sacrifice) For more info on these, check out our blogs:

A Quick and Easy Guide to Tax Deductions in Australia | One Click Life

When do you start paying Tax? – One Click Life

Salary Sacrifice | One Click Life

If you’d like some more info on how it all works & what may have contributed to your Tax Debt, Read on!…

Taxable Income

The amount of Income Tax you pay depends on your income. More income = more tax. If you’re employed, whether it be full-time or part-time, your employer takes money from your pay and gives it to the ATO. When tax time comes around, once tax deductions have been applied to your payment summary, if you’ve paid too much tax, you get a Tax Refund. (Green numbers!) If you haven’t paid enough tax, you get a Tax Payable. (Red numbers ☹)

Now, you may ask “Why haven’t I paid enough tax, isn’t my boss supposed to be responsible for that?!” You employer is responsible for remitting tax to the ATO based on the income you earn each pay cycle. But there are also other forms of income that you may not be considering such as contracting, bank interest, dividends and the list can go on!

What taxable income can contribute to a Tax Debt?

If you’re an Australian resident for tax purposes, the income you earn in Australia and overseas above the tax free threshold ($18,200) will be taxed, regardless of how you received it.

Some common forms of extra income include:

- Wages

- Centrelink payments

- Jobseeker payments

- Crypto

- Shares

- Investments

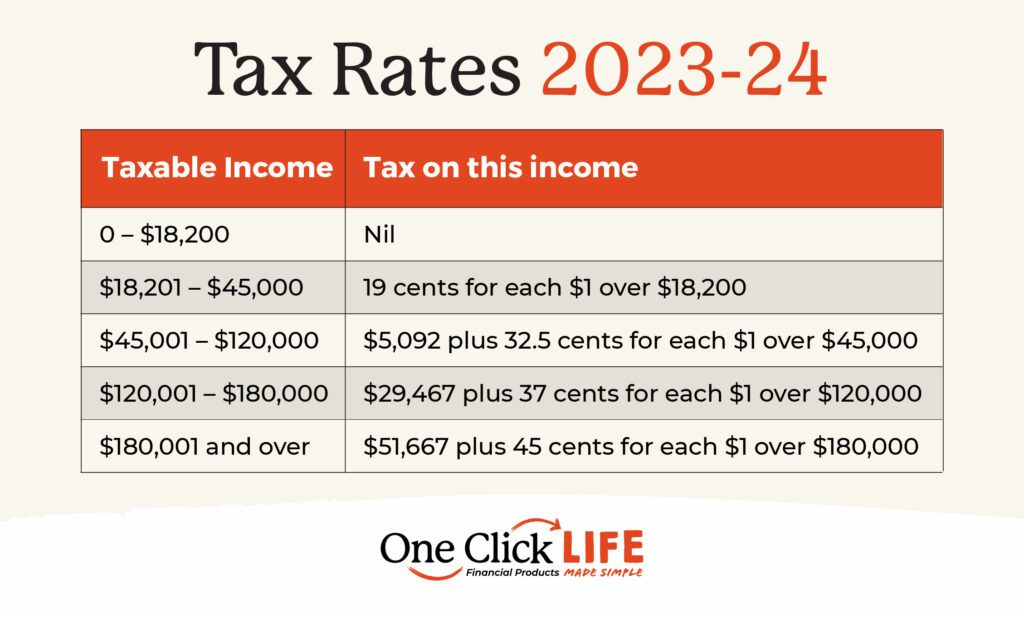

The tax you owe is calculated based on what tax bracket your combined income falls under. If during the year the ATO hasn’t received enough tax from you or your employer, you will owe them money. This crystalises once you lodge your tax return.

The above rates do not include the Medicare levy of 2%.

Individual income tax rates | Australian Taxation Office (ato.gov.au)

Click Here for more info on Tax Free Thresholds

If it’s all a bit too overwhelming or confusing, fear not!

At One Click Life, we are here for you! Our Numbers Geeks can have a look over your lodgement and see if there is anything we can do to reduce your Tax Debt or have a look over the figures to help you put a plan in place for next year. Remember, we charge for online tax lodgements, but our advice is free when you lodge your tax through One Click Life!

Give a Numbers Geek a call on 1300 707 117 or email at [email protected]