When is my Tax Return Due?

If you have an active Tax File Number (TFN), you are required to lodge a Tax Return every financial year. If you don’t lodge your Tax Return before the ATO lodgement date, the 31st of October your Tax Return is overdue. And if you have an overdue Tax Return – there is a possibility you can be fined & even prosecuted!

Failure to Lodge Penalties from the ATO (FTL Penalty)

The ATO can impose penalties (called a Failure to Lodge (FTL) Penalty) if you fail to lodge your Tax Return on time. These are calculated based on penalty units. The penalty unit for each financial year can be charged up to 5 times per person. The table below shows the maximum you can be charged per year your Tax Return goes un-lodged. If the ATO decides to impose penalties. If you had a tax debt, there may also be interest charged on that debt.

| When infringement occurred | Penalty unit amount ($) | Maximum ATO failure to lodge penalty ($) |

| On or after 7 November 2024 | 330 | 1,650 |

| 1 July 2023 to 6 November 2024 | 313 | 1,565 |

| 1 January 2023 to 30 June 2023 | 275 | 1,375 |

| 1 July 2020 to 31 December 2022 | 222 | 1,110 |

| 1 July 2017 to 30 June 2020 | 210 | 1,050 |

| 31 July 2015 to 30 June 2017 | 180 | 900 |

| 28 December 2012 to 30 July 2015 | 170 | 850 |

| Up to 2012 | 110 | 550 |

What happens next?

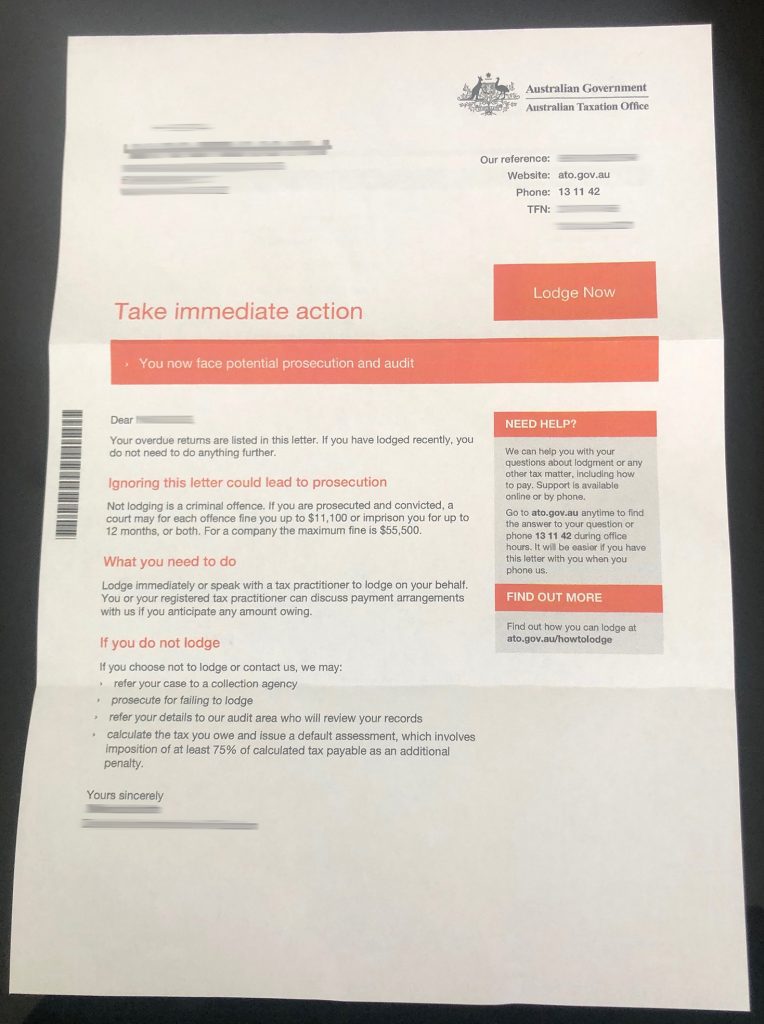

The ATO take failing to lodge quite seriously. Even if you don’t owe any taxes, the ATO will automatically see who has & hasn’t lodged their Tax Returns & send letters like the one below!

Why should I lodge my Tax Return?

Apart from avoiding getting fined or threatened with prosecution, here are some other reasons to get your Tax Return(s) squared away.

PEACE OF MIND

No one needs the added stress of worrying about things like late Tax Returns. Completing your Tax Return online is so quick, easy & convenient, you can get it done in about 15 minutes then get back to the fun stuff 😊

CASH

The average return in Australia is $2600. If you haven’t done your Tax Return, that’s money that you’re missing out on. No more need be said.

One Click Life was created to change the way Australians tackle annoying (and sometimes daunting) Life Admin tasks. We want to make it easy, affordable & be as helpful as possible, helping you get it all done.

Tax Returns are one of those tasks. We want to make sure that everyone is tax compliant (following the rules & not getting in trouble with the ATO). Part of this is letting you know of any outstanding Tax Returns and help you lodge them to avoid these penalties.

THE CLOCK IS TICKING! Log In and lodge your online Tax Return today!

Do you have an outstanding Tax Return?

If you missed doing your Tax Return last year don’t worry, you’re not alone! There are many Australians that have failed to lodge, and sometimes more than once! And there are lots of reasons why they have let their Tax Returns become overdue. Some are so busy they simply forget. Others find the world of tax overwhelming & confusing so avoid it & act like it doesn’t exist. Then there’s Aussies who are just plain lazy.

Boldest excuses for late tax lodgement! – One Click Life

Whatever the reason you may not have done your Tax Return, it’s all good – The crew at One Click Life aren’t here to judge! We’re just here to help get it done!

If you have overdue Tax Returns from 2017 or later, you can LOG IN to our system to lodge your Tax Return online yourself! If your overdue Tax Returns are for Financial Years earlier than 2017, feel free to contact one of our accountants. We will be able to assist you in lodging these overdue Tax Returns, as well as checking if any further correspondence or action with the ATO is required.

Normally, it will take 14-21 business days for ATO to process your Tax Return. However, if it is a prior year Tax Return then it could take a bit longer than usual (around 30 days).

Check out our step-by-step guide & Lodge your Late Tax Returns easily with One Click Life!

Do you have any questions or need a hand lodging?

Please give us a call on 1300 707 117 to speak to a Life Admin expert or Log In to your account using the button below:

Need help finding your Tax File Number: Click Here