Not claiming all your deductions is like leaving the ATO a tip a tax time to thank them! Read on to make sure you know what you can deduct this tax time so you’re not leaving the ATO a tip.

Tax deduction is a tricky area of tax that a lot of people get confused over. What is it? Why do you deduct tax? What can you deduct? When it comes down to it, there are three main criteria that qualifies an expense for tax deduction that is calculated against your income:

- You must have spent the money

- It must be related to your job

- You must have a record to prove it

However, this in itself can be hard to understand. What constitutes an expense as “related” to your job? Here is a list of expenses for bartenders that are tax deductible for your online tax return.

Remember, a record isn’t necessarily a receipt. There are tax deductions you can claim without a receipt. Continue on to find out more.

What Is Your Taxable Income

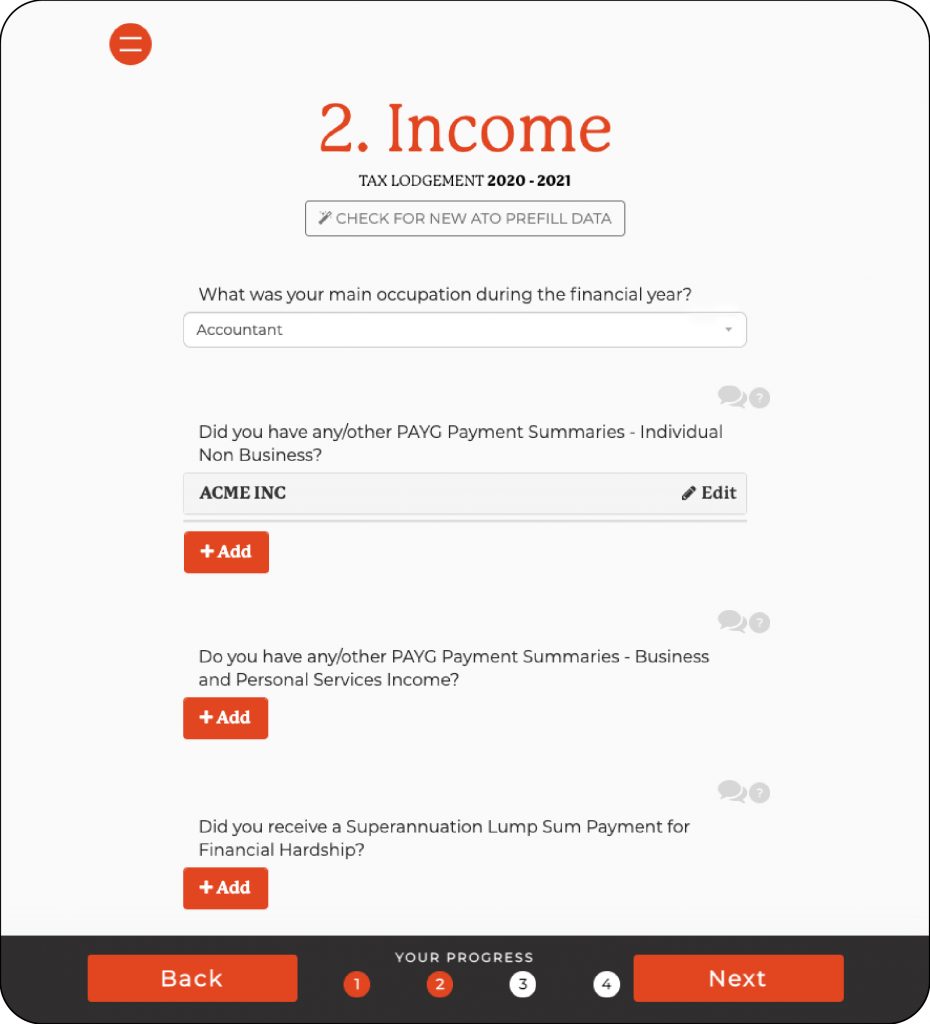

Your taxable income is any money you get from your employer or your work. These things also include:

- PAYG summaries

- Pensions and government allowances

- Interest earned (banks etc)

- Dividends

- Rental property income

- Business income

- Other income earned (capital gains etc)

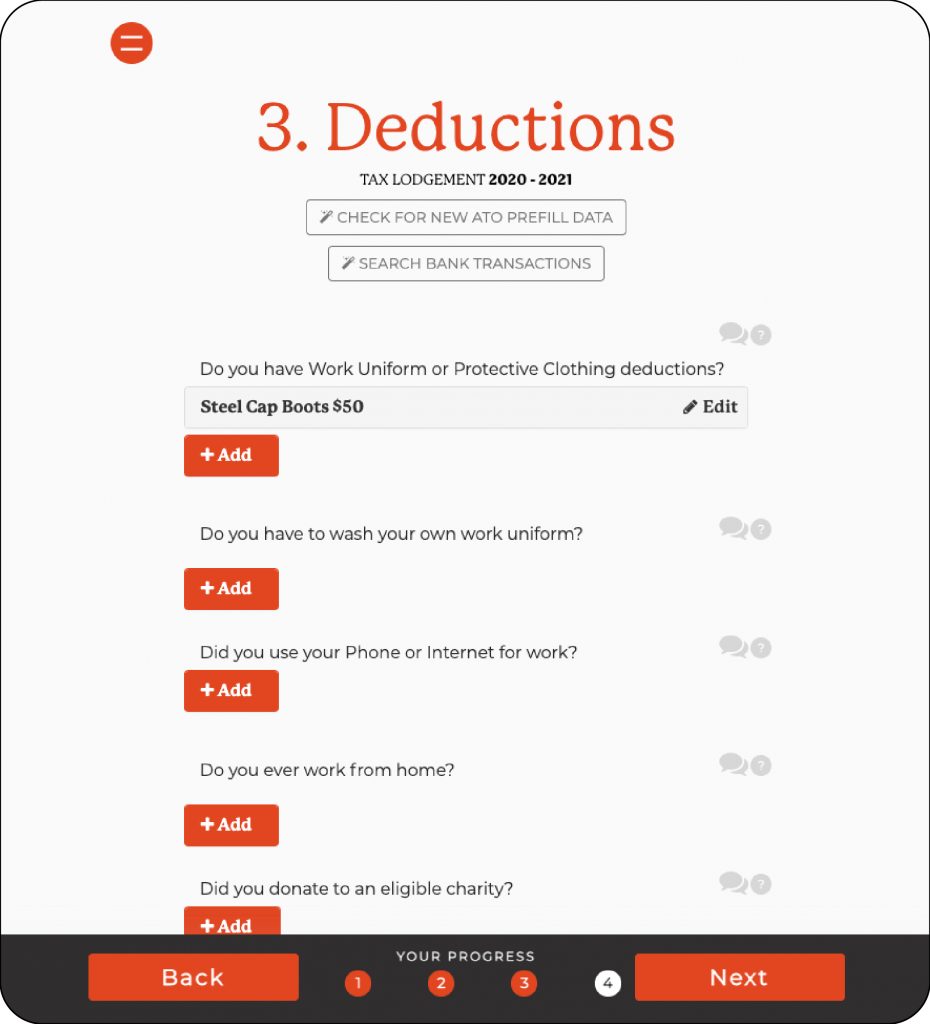

Tax Deductible Expenses for Bartenders, Australia

Bartender Specific

- Purchasing uniforms with logos

- Protective/work specific clothing (aprons, non-slip shoes etc)

- The cost of laundry for protective items and uniforms up to $150

- Purchase of equipment like bar tools etc

- Education & courses related to your work (bartending course etc)

- License renewals required (RM/RSA/Gaming renewal, Safe food handling etc)

- Union Fees

- Driving between two places of work in your own vehicle or picking up stock. This is usually best claimed using the cents per km method of claiming a tax deduction. You cannot claim driving to and from work.

General

- Car expense and wear (estimated cents per km or a logbook with all expense items)

- Travel expenses (flights, taxis and trains etc)

- Accommodation for work related reasons (including meals)

- Work phone expenses

- Work related (as a percentage if shared with personal use) for computing

- Home office expenses that relate to work

- Self-education expenses if they relate to your work

- Last year’s tax return fee

- Insurance

- Rental property expense (if you are renting)

- Charity donations

- Sunglasses and sunscreen (if you have to work outside)

Maximising Your Tax Return With An Online Tax Service

There will be more you can deduct that isn’t on this list. Tax deductions are not only industry specific, but also change from individual to individual.

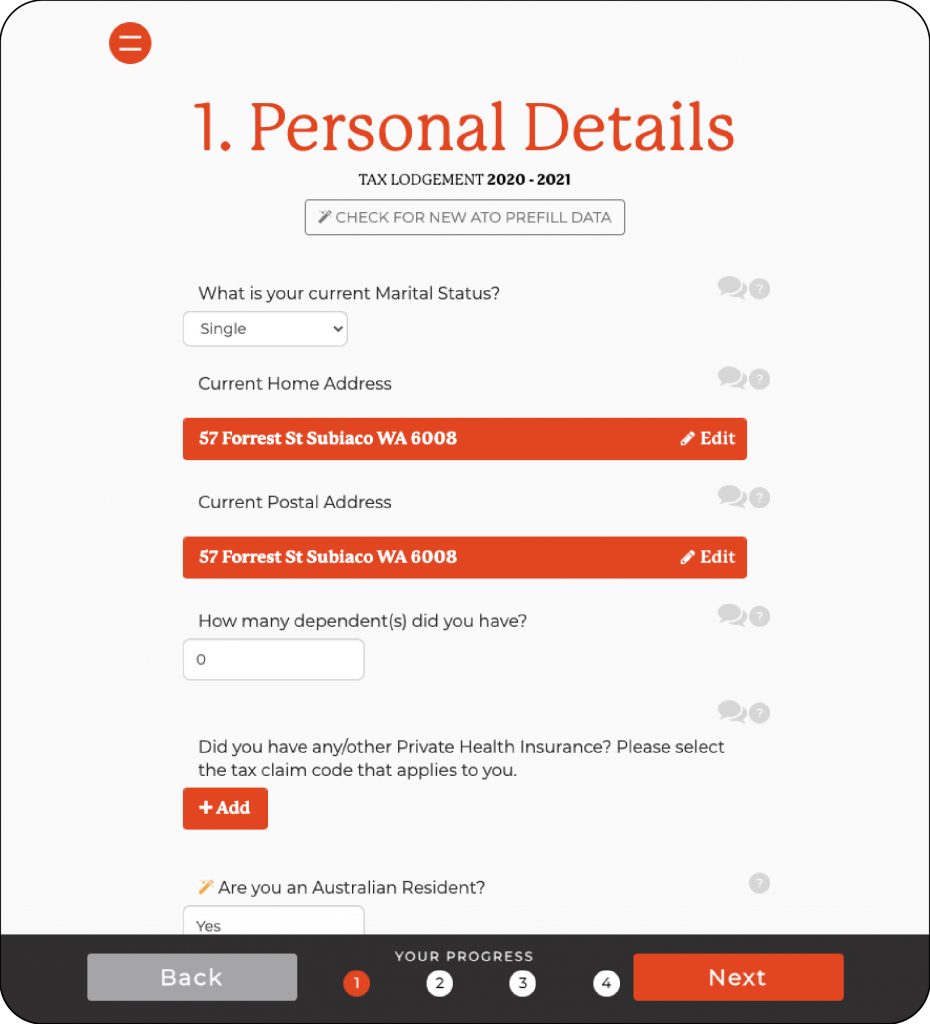

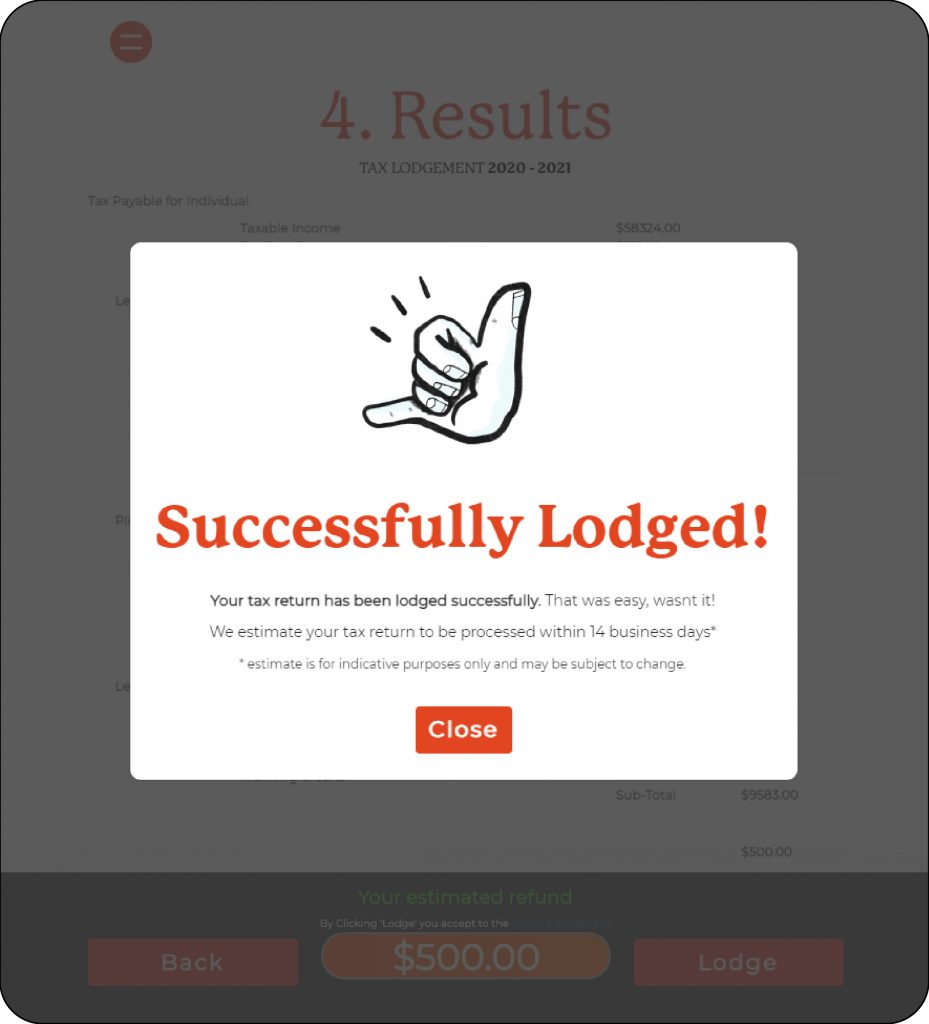

The best way to claim the most you can is with a tax agent like One Click Life. We have made the process simple with 5 easy steps.

The more you deduct, the less tax you pay and the more money you can spend on yourself. Clearly, you will want to deduct the most you can, and the sure-fire way to do that is with a tax agent or accountant. If you can claim your tax agent/tax return fee back on tax, why wouldn’t you use one to minimise your tax?

One Click Life offers fast online tax returns at your fingertips in an easy-to-use platform run by industry professionals.

Taxes, health insurance, and wills can be time-consuming and tedious. Our app allows you to be able to do this fuss-free, giving you a simple way to organise, track and manage all of your life admin in one place.

Let One Click Life take care of your tax return, and life’s essential tasks so you can spend more time doing the things you love.