Tax deductions can be as confusing as passengers not being able to raise their backrest during landing and takeoff. Is it really that hard? It doesn’t have to be! In both situations, all it takes is a little understanding as to how and why.

We think tax is pretty straight forward, but, we’re numbers geeks! We’ve set out this easy to use guide to help you get the most out of your tax return and hopefully assist in making it a bit easier!

Generally speaking, to be able to claim work related deductions, the ATO requires you to meet the following criteria:

- You must have spent the money yourself

- The expense must be related to your job (earning an income)

- You must not have been reimbursed

- You must have a record to prove it (usually a receipt)

- If the expense was for work and personal, you can only claim a portion of the costs related to work

Remember, a record isn’t necessarily a receipt. There are tax deductions you can claim without a receipt. Continue on to find out more.

Below we have set out what defines your taxable income, and a list of some of the expenses that you as cabin crew can deduct on your next online tax return.

What Is Your Taxable Income

Your taxable income is money generated from your employer or your work. (You’ll receive a PAYG summary for this each financial year). Your taxable income also includes other income that you generate outside of work, which can include:

- Pensions and government allowances

- Interest earned (banks etc)

- Dividends / Shares / Crypto

- Rental property income

- Business income

- Other income earned such as capital gains etc.

Tax Deductible Expenses For Cabin Crew

Cabin Crew Specific

- Buying compulsory airline uniforms

- The cost of laundry for clothes/uniforms that is worn for your job

- Protective items like sunglasses, sunscreen and moisturisers (you can’t claim for grooming products, conditioners or cosmetics unless they are rehydrating due to the abnormally dry environment of an aircraft)

- Up to $300 of equipment (branded bags, first aid kits, diaries)

- Depreciation of tools and equipment over $300

- Luggage and overnight bags

- Leasing or repair of work related tools

- Job related self-education

- Airline/cabin crew books, journals and subscriptions

- Work union fees/other similar organisations

- Loan interest payable for work related equipment

- Visas and passports

Meals

You can claim a deduction for the cost of meals under the following circumstances:

- When you travel away from home overnight for work,

- You were working overtime, had a break and purchased a meal, or

- You were paid an overtime meal allowance under an industrial law, award or agreement.

General tax deductible expenses

- Car expenses and general wear (estimated Km or a logbook with all expense items)

- Travel expenses for your work (flights, taxis and trains etc)

- Accommodation needed for work reasons (including meals)

- Phone bills

- Work related computing

- Working from home costs

- Self-education

- Tax return fees dating to the year previous

- Insurances

- Rental expense (if you are renting)

- Charity donations and gifts

- Sun protection (if you have to work outside from time to time)

- Driving between two places of work in your own vehicle. This is usually best claimed using the cents per km method of claiming a tax deduction.

Maximising Your Tax Return With An Online Tax Service

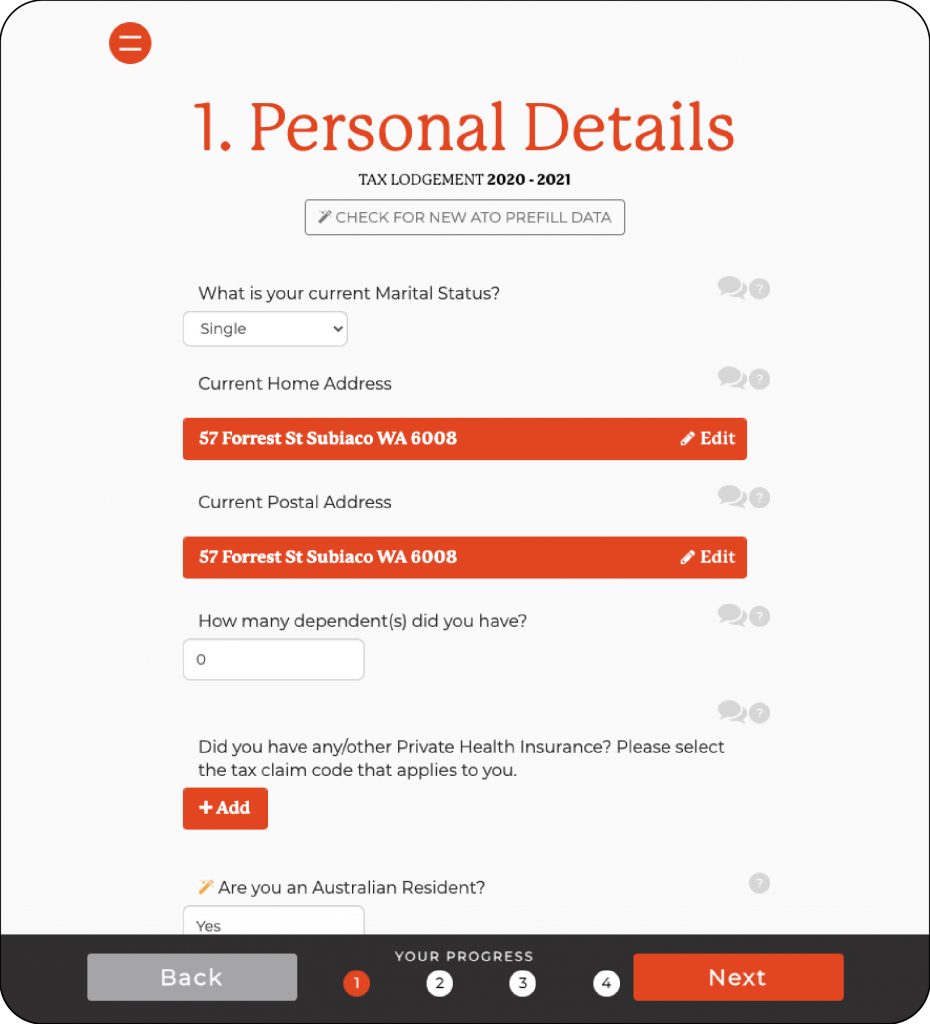

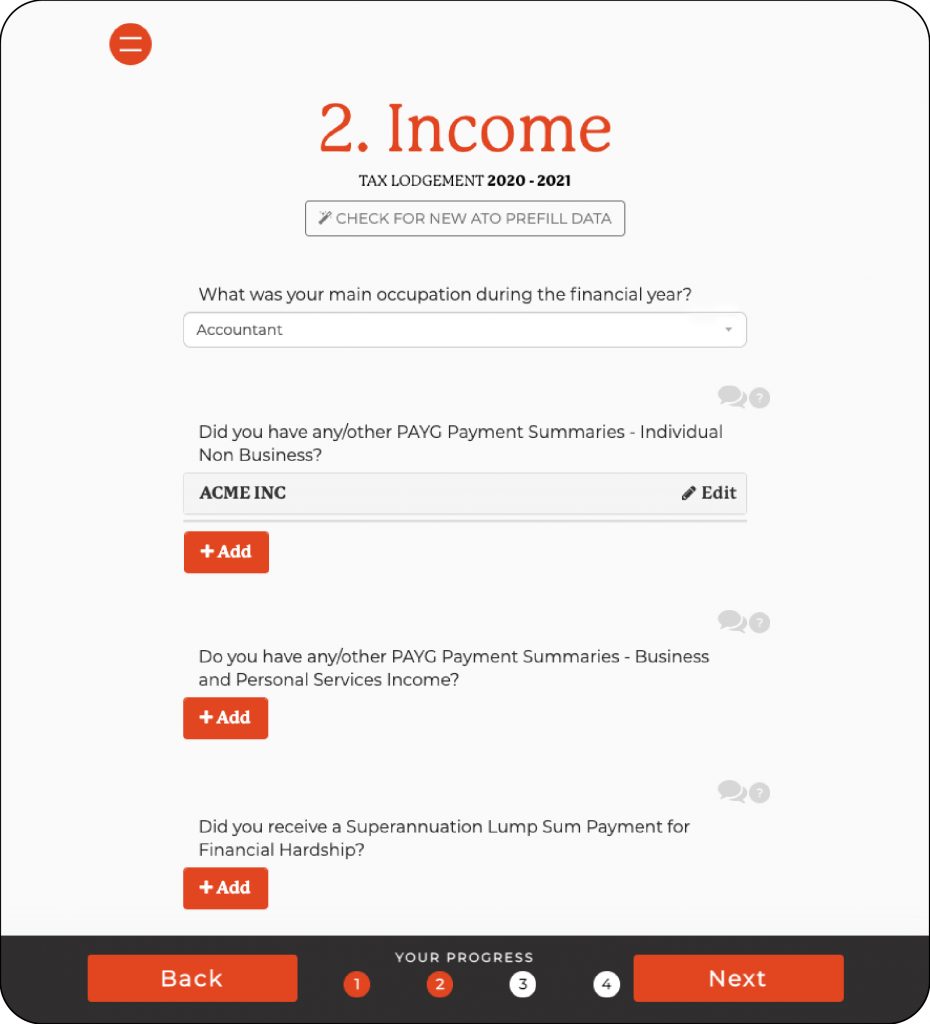

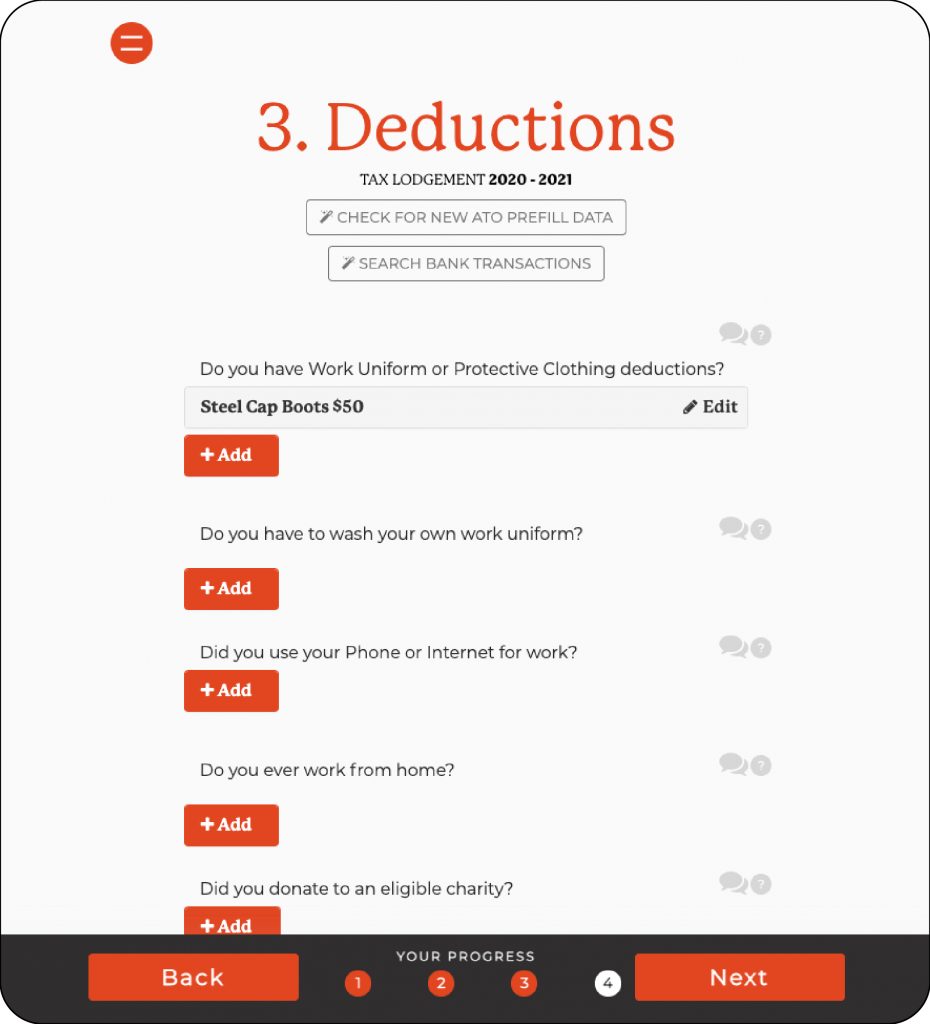

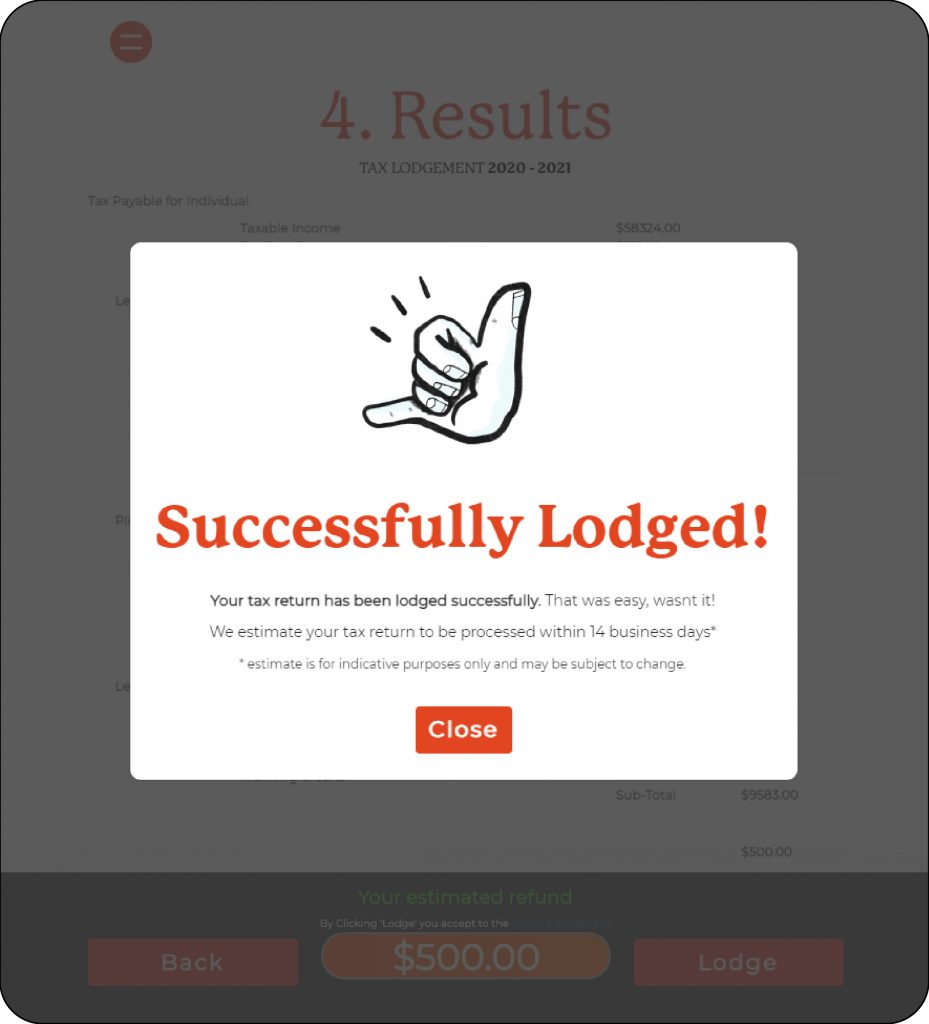

The best way to claim the most you can is with a tax agent like One Click Life. We have made the process simple with 5 easy steps.

When you start your Online Tax Return with One Click Life, you will be asked to enter your Occupation. From there, pre-populated deductions based on your occupation will appear. The beauty of this section is the in-built tax deductions calculator, which automatically re-calculates your tax refund every time you add or edit your deductions. This provides you with the most accurate estimate of your tax refund.

The more you deduct, the less tax you pay and the more money you receive in your Tax Refund. That’s more money you can spend on yourself! More money is a good thing to have! So you will want to deduct the most you legally can, and one way to do that is using a tax agent like One Click Life. You can even claim our small fee on your next Tax Return. WINNING! 🙂

Remember, you don’t have to face the ATO alone. At One Click Life, we have made doing your Online Tax Return convenient, easy and stress-free. There’s no messy paperwork or confusing tax lingo. We’re on your side to help you get a better tax refund while making sure you’re in the good books with the ATO.

Taxes, Health Insurance, and Wills can be time-consuming and tedious. One Click Life offers you a much simpler way to organise, track & manage Life Admin all from one convenient fuss-free dashboard.

It’s all just ONE CLICK away