We have a job for you, and this time you are your own client. Build yourself a good foundation for your tax return by claiming all of your work related expenses as tradie tax deductions. Don’t leave anything out of your online tax return. If you save every little bit, and deduct everything you’re entitled to, the tax return can be massive.

When it comes down to it, there are three main criteria that qualifies an expense for ATO deductions, which is calculated against your income:

- You must have spent the money and not have been reimbursed

- It must be related to your job

- You must have a record to prove it

However, this in itself can be hard to understand. What constitutes an expense as “related” to your job? Here is what defines your taxable income, and a list of expenses that you as a tradie in Australia can deduct on your next online tax return.

Remember, a record isn’t necessarily a receipt. There are tax deductions you can claim without a receipt. Continue on to find out more.

What Is Your Taxable Income

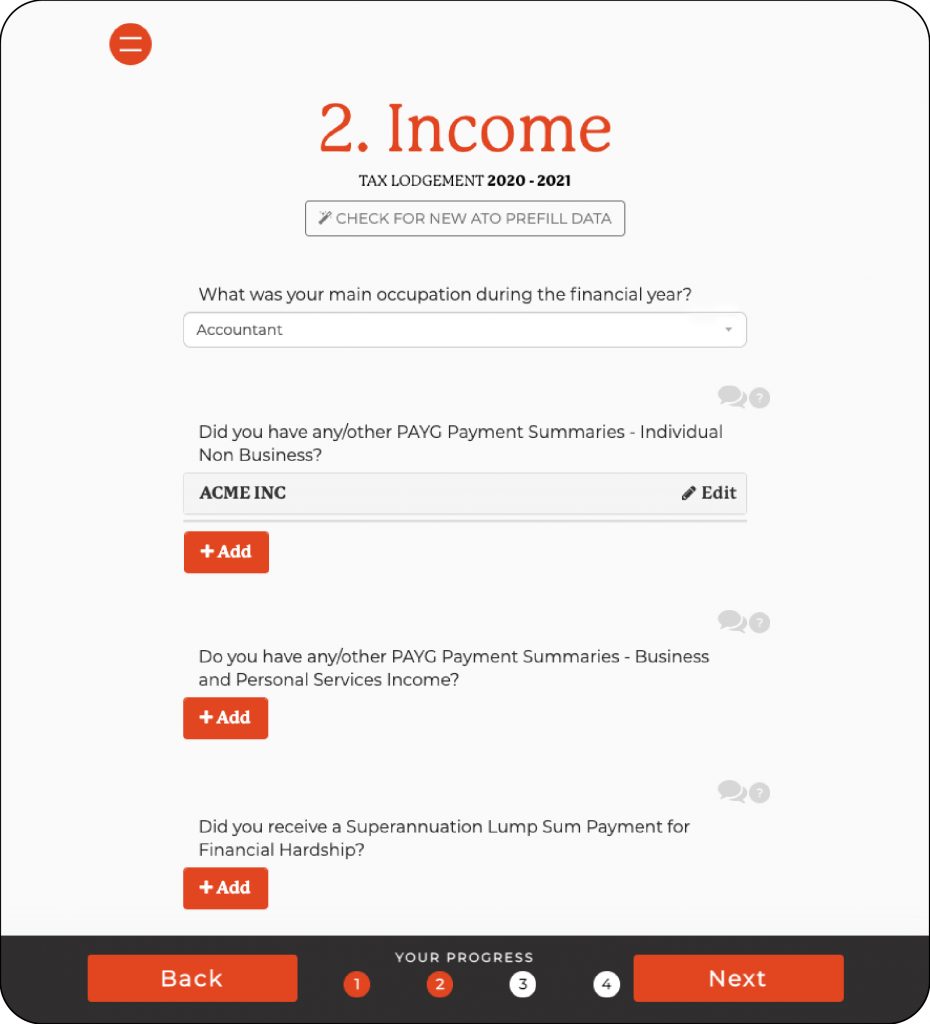

Your taxable income is money generated from your employer or your tradie work. Your taxable income also includes:

- PAYG summaries

- Pensions and government allowances

- Interest earned (banks etc)

- Dividends

- Rental property income

- Business income

- Other income earned (capital gains etc)

Tax Deductible Expenses For Tradies

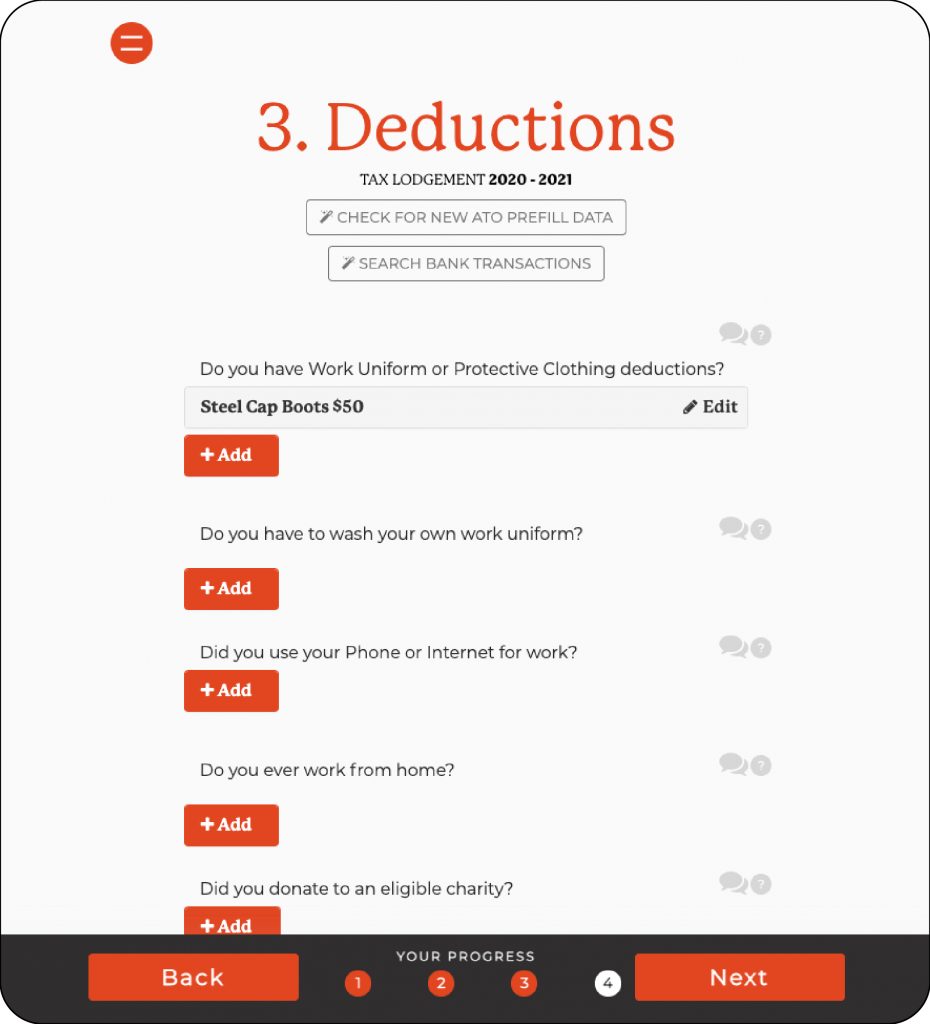

Tradie Specific

- Buying any tradie clothes/uniforms

- The cost of laundry for tradie clothing/uniforms that you use for your work

- Protective clothing items (hi vis, boots, helmets, sun protection etc)

- Purchase of equipment and tools (hammers, screwdrivers etc) up to $300

- Depreciation expense of equipment and tools (saws etc) over $300

- The repair and/or upkeep of tradesperson tools and equipment

- Interest generated from loans relating to work activities

- Self-education and courses for work

- Tradesman mobile phones in Australia

- Licences for tradies

- Fees from joining a union/other similar organisations

- Subscriptions and magazines relating to your tradie work

- Travel expenses if work related (conferences etc)

- Car expenses

Tradie Protective Gear

This will probably be one of the bigger deductions you can claim. All of the hard hats, protective glasses, protective boots and everything in between can be claimed on tax, so make sure you keep evidence of the purchase.

Tradie Work Clothes Tax Deduction

You are allowed to claim tax deductions for your work clothes if they have a company name or logo on them. You can also claim a tax deduction for protective clothing such as steel cap boots. Clothing deductions also extends to sun protective clothing

All clothing tax deductions also include both buying and the laundry. Laundry expenses are limited to $150 a year.

Claim Tax on Tools

If you are a tradesperson, you will no doubt be buying a lot of different tools. You can claim tax on tools you purchase by including them in your tax return. Make sure you keep the receipts for these tools. For many tradies tools are the biggest expense after your vehicle running costs. We don’t want you to miss claiming the tax back on these tools!

Car Expenses

You can claim car expense tax deductions in your tax return if you are carrying bulky, heavy tools and equipment that can not be stored safely at your place of work

There are two methods you can use to calculate your tax deductible expense:

- Cents Per Kilometre: You can claim a certain amount of cents per kilometre you travel for work *(up to 5000km)

- Logbook: You can keep a logbook over 12 weeks to calculate what percentage of your car you use for work, and claim that percentage of your expense as a tax deduction.

Mobile Phone

The ol’ tradie phone. Haven’t seen one yet without a crack or two in the screen!

As a tradie, you probably use your phone for work to communicate with clients and managers. You can claim a tax deduction for your mobile phone costs, however you’ll need to take into account your personal usage. Check out our blog for more information on mobile phone tax deductions.

What Can Tradies Claim on Tax Without Receipts?

There are a number of expenses you can claim without receipts. If you’re in a situation where you haven’t kept any receipts, read on for the deductions you can claim. However, in future – keep your receipts! You will receive a bigger tax refund by claiming all your tax deductions.

Here’s the list of what tradies can claim on tax without receipts:

- Car expenses – cents per km claim. Keep a log of your travel and this one max’s out at 5,000kms.

- Working from home – need to do your calls, emails and diary management, order supplies, send invoices from home? Keep a log of the hours you spend and claim your working from home expenses.

- Laundry – Gotta keep the protective clothing clean! You can claim up to $150 a year on this one.

Additionally, for you phone bills, if you don’t have the receipts, call your carrier service and ask them to email them to you.

General Tax Deductions

- Car expenses and general wear (estimated Km or a logbook with all expense items)

- Travel expenses for your work (flights, taxis and trains etc)

- Accommodation needed on work reasons (including meals)

- Phone bills for work

- Work related computing

- Working from home costs

- Self-education

- Tax return fees dating to the year previous

- Insurances

- Rental expense (if you are renting)

- Charity donations and gifts

- Sun protection (if you have to work outside)

Maximising Your Tax Return With An Online Tax Agent

There will be more tax deductions for tradespeople that aren’t on this list. Tax deductions are not only industry specific, but also change from individual to individual.

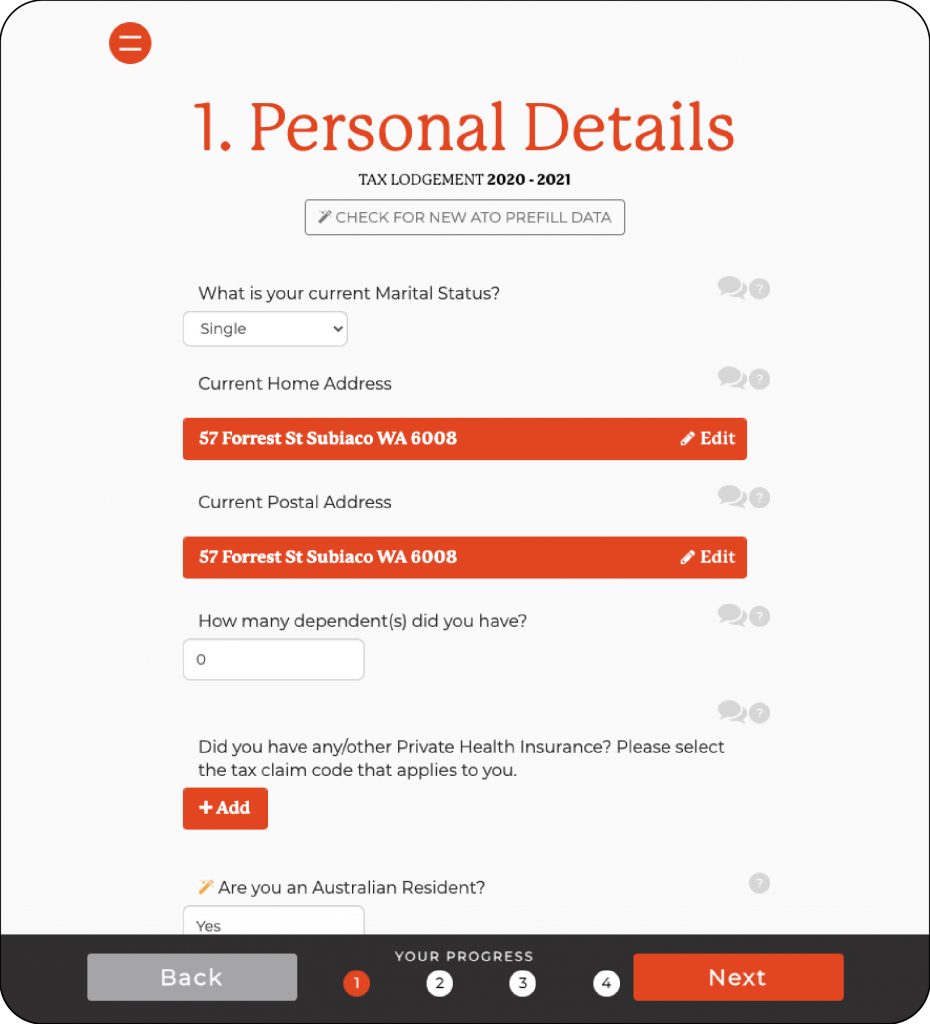

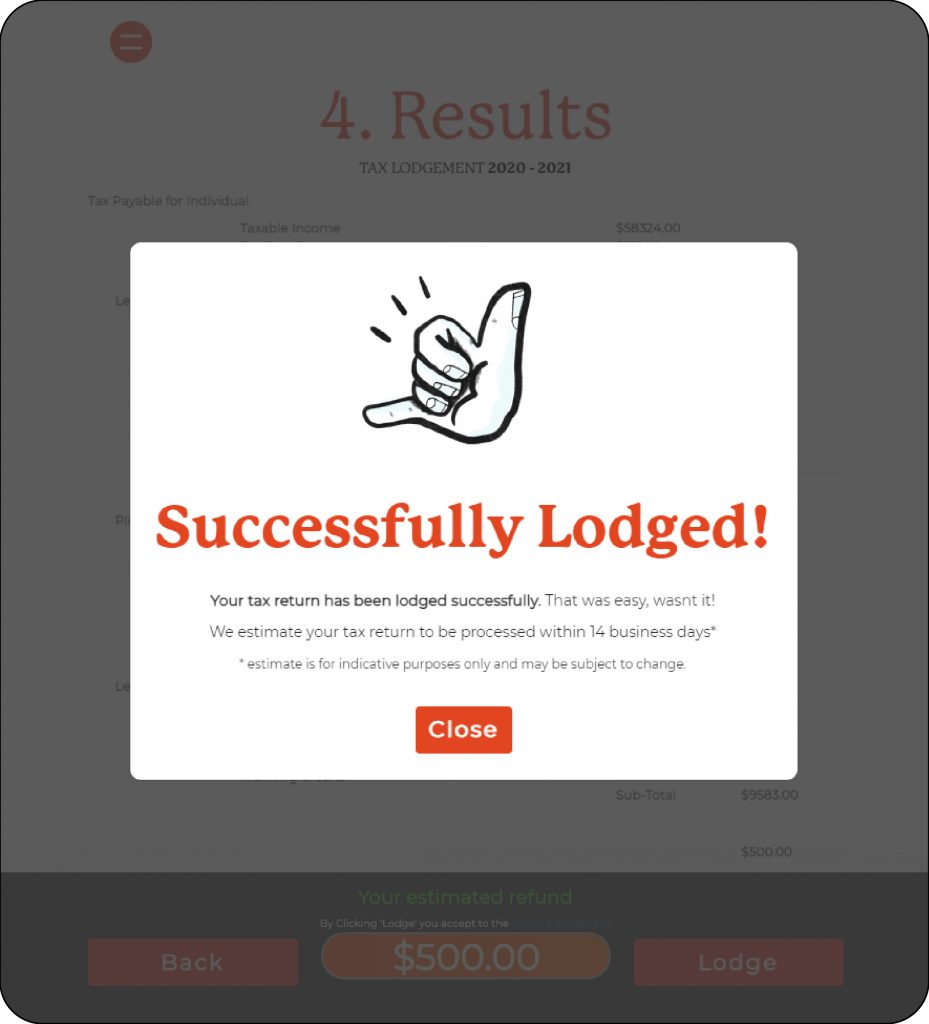

The best way to claim the most you can is with a tax agent like One Click Life. We have made the process simple with 5 easy steps.

Usually the rule of thumb is 5 years to keep your receipts, but if you want to know what tax deductions without receipts you can claim, ask a professional.

The more you deduct, the less tax you pay and the more money you can spend on yourself. Clearly, you will want to deduct the most you can, and the sure-fire way to do that is with a tax agent or accountant. If you can claim your tax agent/tax return fee back on tax, why wouldn’t you use one to minimise your tax?

One Click Life fast offers online tax returns at your fingertips in an easy-to-use platform run by industry professionals.

Taxes, health insurance, and wills can be time-consuming and tedious. Our app allows you to be able to do this fuss-free, giving you a simple way to organise, track and manage all of your life admin in one place.

Let One Click Life take care of your tax return, and life’s essential tasks so you can spend more time doing the things you love. For more tax for tradies, come visit us!