HECS is a popular student loan option for Australian students in higher education programmes like university. As higher education courses can cost tens of thousands, obtaining a student loan is almost essential. Australian students can study with peace of mind, knowing their student debt will be manageable in the future with this handy HECS Repayments Guide.

This blog is for you if you are a current or future higher education student in Australia who wants a loan for your studies. In this article, we will provide a guide covering everything you need to know about HECS loans.

What is HECS?

HECS or HECS HELP is an interest-free loan from the Australian government that helps eligible students pay for their higher education. Higher education or tertiary education consists of awards from the Australian Qualifications Framework (AQF) levels 5-10, that span from diplomas up to higher doctoral degrees.

The government pays the educational institution directly, and students repay the loan through the tax system once they start earning above a certain threshold (this will be discussed in detail later in the blog).

Students can also make voluntary payments at any time to pay down their debt. HECS loans are available at all public universities and selected private higher education institutions.

Who is eligible for HECS?

For you to be eligible for a HECS student loan, you must meet the following criteria:

- Study at a Commonwealth supported place;

- Be an Australian citizen, or New Zealand Special Category Visa holder with long-term residency, or a permanent humanitarian visa holder;

- Enrol in your subject/units by the census date;

- Submit a Request for Commonwealth support and HECS form by the census date.

How to check HECS debt balance?

There are 3 simple ways of checking your remaining HECS debt balance. You can use the OCL platform or contact the ATO directly.

1. Use OCL to check your HECS debt balance

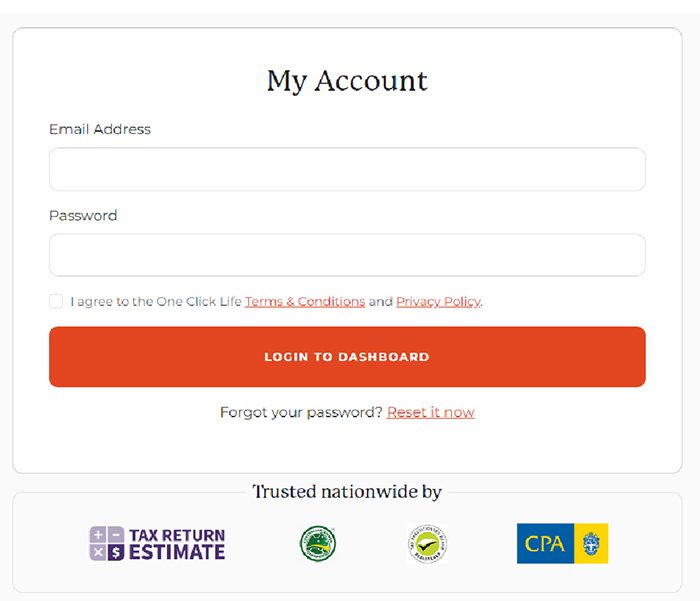

As easy as 1, 2, 3, you can check your HECS debt by logging into your OCL account and viewing your balance on the website.

1: Log in to your One Click Life account.

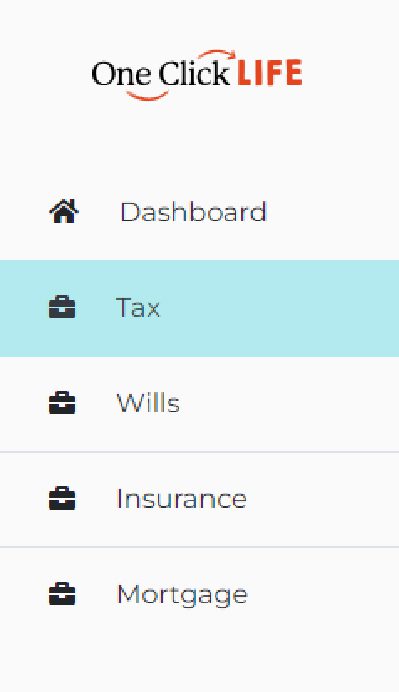

2: Click on the ‘TAX’ tab located on the left side of the screen.

3: Your remaining HECS loan amount will be displayed.

2. Contact the ATO

You can call the ATO directly by phoning 13 28 61, between 8 am and 6 pm AEST, Monday to Friday. You may be waiting on hold as the ATO process can be lengthy.

How to calculate HECS Repayments?

To calculate HECS repayments you can use our HECS calculator. This will allow you to calculate your HECS debt that is required to be paid to the ATO based on your income. Check out the table below to see how much you need to earn to commence making HECS repayments.

When are you required to make HECS Repayments?

The HECS repayments rates are determined by your income. The percentage of income you must contribute towards your HECS loan is known as the repayment rate. HECS is not required to be paid until you reach the HECS repayment threshold.

The repayment threshold for 2022-23 was $48,361 and $51,550 for the 2023-24 period.

Under the current rules set by the government, you will never be required to pay off your student debt until you earn over the given thresholds. Alternatively, a HECS repayments calculator is an easy way to calculate your HECS repayment rate.

Below are the HECS repayment thresholds and rates for 2022-2023 and 2023-2024.

| 2022-2023 HECS Repayment threshold | 2023-2024 HECS Repayment threshold | HECS Repayment % rate |

| Below $48,361 | Below $51,550 | Nil |

| $48,361 – $55,836 | $51,550 – $59,518 | 1.0% |

| $55,837 – $59,186 | $59,519 – $63,089 | 2.0% |

| $59,187 – $62,738 | $63,090 – $66,875 | 2.5% |

| $62,739 – $66,502 | $66,876 – $70,888 | 3.0% |

| $66,503 – $70,492 | $70,889 – $75,140 | 3.5% |

| $70,493 – $74,722 | $75,141 – $79,649 | 4.0% |

| $74,723 – $79,206 | $79,650 – $84,429 | 4.5% |

| $79,207 – $83,958 | $84,430 – $89,494 | 5.0% |

| $83,959 – $88,996 | $89,495 – $94,865 | 5.5% |

| $88,997 – $94,336 | $94,866 – $100,557 | 6.0% |

| $94,337 – $99,996 | $100,558 – $106,590 | 6.5% |

| $99,997 – $105,996 | $106,591 – $112,985 | 7.0% |

| $105,997 – $112,355 | $112,986 – $119,764 | 7.5% |

| $112,356 – $119,097 | $119,765 – $126,950 | 8.0% |

| $119,098 – $126,243 | $126,951 – $134,568 | 8.5% |

| $126,244 – $133,818 | $134,569 – $142,642 | 9.0% |

| $133,819 – $141,847 | $142,643 – $151,200 | 9.5% |

| $141,848 and above | $151,201 and above | 10.0% |

For example, if you earned an income of $90,000, in 2022-23 you would be required to pay 6% of your income or $5,400. In 2023-24 you will be required to pay 5.5% of your income to HECS or $4,950.

If you are looking for a HECS repayments calculator to find your HECS repayment rate quickly, why not use One Click Life’s HECS Calculator?

HECS Indexation 2023

HECS doesn’t incur interest like most loans, rather it is indexed with the lessor of inflation or the wage price index from July 2023. Indexation means the amount you are required to pay on your loan is adjusted at the same rate as a specific measure. In this case, HECS increases at the same rate as inflation, or from July 2023 the wage price index – whichever is lower. The index rate applies on June 1 yearly.

For example, the index rate for June 2023 was 7.1% and the wage price index 3.2%. A student with a $30,000 HECS loan would see their loan increase by $960 to $30,960.

Inflation was particularly high for 2023, which is why we used wage price index in the example. The index rates for previous years have been considerably lower. Indexation rates and the expected loan balance increase on a $30,000 loan are listed below.

- 2023: wage price index 3.2% ($960)

- 2022: 3.9% ($1,170)

- 2021: 0.6% ($180)

- 2020: 1.8% ($540)

- 2019: 1.8% ($540)

If you would like a more in-depth look into HECS indexation 2023-2024, read our blog on the topic, here.

Interesting facts about your HECS debt

You can reduce your HECS repayments in a year, make additional HECS repayments and more with a bit of knowledge! Check out below tips about HECS debt:

1. Claim all the deductions you can

Reducing your taxable income, reduces your HECS repayments. To reduce your assessable repayment income, you should ensure you claim all your tax deductions. This is made easier by using the One Click Life platform to do your tax return. Reducing your assessable income also means paying less tax.

2. Make additional HECS repayments

You can make additional payments before June 1st to avoid paying the index increases. This can be useful if the index rate is high such as 2023’s rate of 7.1% prior to the 2024 federal budget changes.

3. Check your HECS balance

You can check your HECS debt for free creating a free account with One Click Life. This allows you to view your HECS debt and you’re able to prepare a free tax estimate to calculate your HECS repayments.

Create FREE One Click Life account4. Speak to an accountant

If you are looking to make a large voluntary HECS repayments, you should speak to a qualified accountant. Before lodging your tax return, talk to a One Click Life accountant to ensure you get the most out of your tax return and make the process of repaying HECS debt easier.

For more information, read our blog about repaying HECS debt faster, here.

What to consider before making additional HECS repayments

Before making additional payments there are some factors you need to consider that depend on your individual circumstances.

1. Income and expenses

Is your income high enough to cover your living expenses and to cover additional HECS debt payments? Before making additional payments, you want to ensure you have money available for living costs and enough to save for unexpected expenses.

2. Your priorities

As HECS debt is interest-free, you may have higher priorities in terms of financial goals. Saving for a car or a house may be more important to you than paying down your student debt.

3. Other debt

If you have other debt such as a mortgage or a car loan with higher interest rates than the index rate, it may be more beneficial to pay those debts off first.

4. Opportunity cost

You can potentially earn a higher return on your money than the index rate that is applied to your HECS debt. That means if you invested the money you would use to pay down your loan, you would have earned more than the indexed amount.

For example, you have $1,000 to invest or pay down your student debt. If an investment opportunity returns 8% ($1,000 x 8% = $80) per year and the indexed rate is 7% ($1,000 x 7% = $70). You are making a gain of $10 by taking the investment opportunity ($80 – $70).

If you only paid down your student debt you would save $70 on indexation but you would be $10 worse off compared to taking the investment opportunity.

5. Credit rating

When applying for a mortgage, lenders will consider the amount of HECS debt you have. Paying down your HECS debt can increase your credit rating, making buying a home easier.

What is the HECS loan limit for 2023?

For 2023, most students will be able to borrow up to a maximum of $113,028 from the HECS program for their courses.

There is a higher limit of $162,336 for medicine, dentistry, vet science students leading to initial registration, and eligible aviation courses.

What is the difference between FEE-HELP and HECS?

HECS and FEE-HELP are both loan programs that help students pay for their education. HECS differs from FEE-HELP as only students attending a Commonwealth Supported Place such as public universities and selected private institutions can obtain HECS loans.

FEE-HELP students receive similar support although, the fees are not subsidised by the government and the approved providers set the tuition fees.

Is paying off HECS tax deductible?

In short, NO! Students who are paying off their HECS debt are not able to claim their payments as a deduction on their tax return. Employers may be eligible for tax deductions if they make repayments on the student’s behalf. Although, employers will have to pay fringe benefits tax on the HECS repayments.

In summary, HECS is an interest-free loan from the government that is indexed with inflation. To be eligible for HECS, Commonwealth supported students must meet the VISA requirements and submit all related forms by the census date. If you are looking to answer the question “how to check HECS debt”, the easiest way to check your HECS balance is to log in to the One Click Life dashboard. You can also check your repayment rate by using the OCL HECS calculator. Students may decide to pay their loans off faster depending on their personal circumstances by making additional payments, claiming all tax deductions, or speaking to an accountant like our team at One Click Life.

Let One Click Life handle your life admin!

One Click Life makes it easy to track all your life administrative tasks in one place. By maximising your online tax return, One Click Life can help you pay off your HECS loans faster. The simplest way to complete your tax return is to work with an online tax agent. Why wouldn’t you use an online tax agent if the fees you pay are tax deductible? We do more than tax! One Click Life can also assist with your Mortgage, Will, and Health Insurance, so you can spend time on things that are important to you.