Want to learn a little bit about the Australian tax system, what tax is and the role of the ATO? Read on to learn all this and more about tax in Australia.

How does the Australian Tax System work?

While working in Australia, the government requires workers to pay taxes. Before you can start working and start earning an income that can be taxed, you need the following:

- Tax File Number (TFN),

- Permission to work in Australia if you aren’t an Australian resident, and

- If you run a business in your own name, an Australian Business Number (ABN)

The tax year in Australia is the same as a financial year which commences on the 1st of July and finished the 30th of June the next year.

You are then required to lodge a tax return after the end of the financial year. A tax return is a summary of all your income, tax that your employer has withheld from your wages and any expenses you incurred in deriving your income. Your tax return will need to be lodged by 31 October each year.

CREATE FREE ACCOUNT NOWThe Australian Taxation Office – The ATO

The ATO is the government agency that collects all the taxes on behalf of the government. The government then uses those taxes to fund our health and education systems as well provide this countries infrastructure amongst other things.

The ATO administers the countries Tax Laws. Additional to collecting income taxes this includes GST, fringe benefits tax (FBT), and other federal taxes.

The ATO also has a role to ensures compliance with tax laws through audits, reviews, and investigations.

Australia’s superannuation system is also overseen by the ATO. It’s the ATO’s role to ensure employers contribute to employees’ super.

Where the ATO finds non-compliance with the countries tax laws it has the ability to hand out penalties including fines and penalties mainly.

What is a Tax File Number?

A Tax File Number, commonly call a TFN, is a 9-digit number that is unique for every person in Australia. It is legally required prior to being employed in Australia.

The purpose of a Tax File Numbers in to be able to identify citizens and foreign workers in Australia for all tax and superannuation purposes. To find out how to get a tax file number, check out our blog.

What is Taxable Income?

In short, taxable income is the amount of income that you need to pay tax to the ATO.

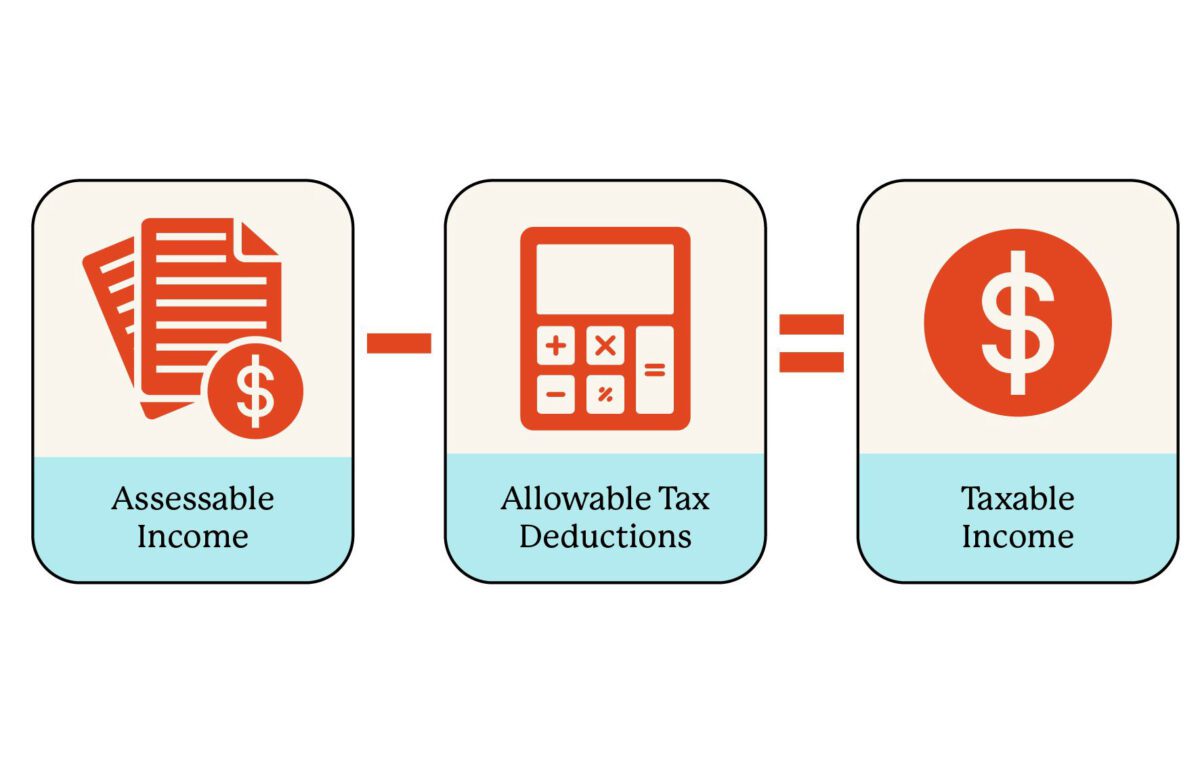

The calculation of Taxable Income is as follows:

Assessable Income – Allowable Tax Deductions = Taxable Income

Assessable Income most forms of income you receive, such as:

- Salary and wages from your employer

- Government payments (e.g. JobSeeker, Youth Allowance – depending on the type)

- Business income

- Investment income (e.g. interest, dividends, rent)

- Capital gains

Allowable tax deductions are deducted from your Assessable Income to calculate your Taxable Income. These include items such as:

- Work-related expenses (e.g. uniforms, tools, travel for work)

- Self-education expenses

- Donations to registered charities

- Investment-related expenses

- Tax agent fees

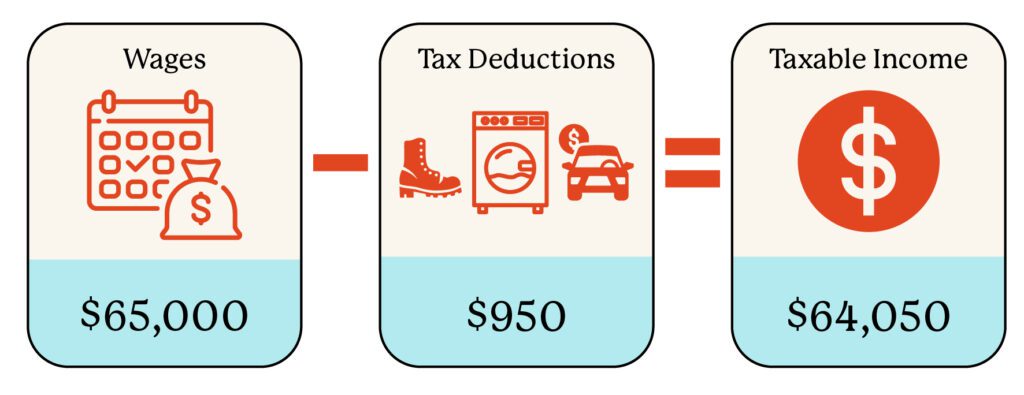

Example:

Bob earns $65,000 a year from his wages. He spent $950 during the year on various tax deductible items like safety gear, laundry, tax agent fees and donations. His Taxable Income, the amount he’ll have to pay tax on is $64,050.

What is a tax return?

A tax return is a summary of all your taxable income and allowable tax deductions that you provide to the ATO so they know how much tax you will need to pay. This covers the financial year: 1 July to 30 June.

Once you lodge a tax return you will receive a notice of assessment from the ATO. You will also receive a refund if your employer has withheld more tax from your wages than required, or you may need to pay tax if you haven’t paid enough tax.

How to lodge the fastest tax return in Australia – One Click Life!

One Click Life is the fastest and most simple way to lodge your tax return in Australia. To lodge your tax return, create a free account here.

Feel free to Contact Us to ask for help. You can also message us through your One Click Life Inbox.

CREATE FREE ACCOUNT NOW